Photo-First Claims: 40 % Lower Handling Costs

Introduction – From Clipboards to Clicks

Imagine this: a car accident happens on a rainy afternoon. Instead of waiting days for an adjuster to arrive, the driver opens their insurance app, snaps a few guided photos of the damage, and hits submit. Within hours, they receive a repair estimate and approval for payment — all without making a single phone call.

This is not a vision of the future. It’s happening right now, thanks to AI-powered image analysis. A growing number of insurance providers are switching to photo-first claims workflows, where damage assessment starts with pictures and not paperwork. This shift is proving to be more than just a convenience — it’s unlocking real business results.

Insurers adopting this model report up to 40% lower handling costs per claim. How? By reducing the need for human adjusters, speeding up the settlement process, and shrinking the window for fraudulent activity. At the same time, policyholders benefit from faster payouts, easier communication, and better overall service. This combination leads to stronger customer loyalty and improved retention rates — key goals in today’s competitive insurance market.

Behind this transformation is a smart use of computer vision technology, which allows machines to "see" and interpret images. With AI models trained to detect damage, identify car parts, and even estimate repair costs, what used to take days or weeks can now happen in real time.

In this blog post, we’ll explore:

Why traditional claim processing is inefficient and costly

How photo-first claims actually work, step by step

The AI building blocks that make this possible

Real-world impact on fraud prevention and cost savings

What insurers should consider when choosing between pre-built tools and custom solutions

Whether you're part of an innovation team inside a large carrier or just curious about the future of insurance, this article will give you practical insights into how images — and the AI that analyzes them — are reshaping the claims process.

The Legacy Claims Bottleneck — Why Manual Workflows Bleed Money

Traditional insurance claims processing has barely changed in decades. It often involves long waits, paperwork, multiple phone calls, and manual inspections. While this method may feel familiar, it’s far from efficient — and it's costing insurers more than they realize.

Let’s break down the major problems with the legacy approach:

2.1 Multi-Day Hand-Offs and Site Visits

When a policyholder reports a car accident, the claim usually starts with a call to a service center. Then, a series of steps follow: scheduling a vehicle inspection, assigning an adjuster, organizing towing if necessary, and finally waiting for a repair quote. Each hand-off adds delays.

Even in the best-case scenario, these steps can take several days to a full week. During this time, the car sits idle, customers grow frustrated, and the insurer pays for extra services like rental cars or temporary storage.

2.2 Human-Only Damage Appraisal Is Inconsistent

Relying solely on human adjusters introduces variation in how damage is assessed and priced. Different people might give different estimates for the same damage, depending on experience, training, or even fatigue.

This lack of standardization can lead to underpayments or overpayments, disputes with repair shops, and poor customer experience. It also increases the chance of errors that require rework and extra communication.

2.3 Fraud and Leakage Add to the Bill

Long claim timelines create more opportunities for fraud. When there’s a delay between the time of the accident and the actual inspection, some claimants may try to add unrelated damage or exaggerate the impact.

This is known as “leakage” in the insurance industry — and it’s costly. Fraudulent or inflated claims can represent up to 10–15% of total payouts, especially in auto insurance. The longer it takes to process a claim, the harder it is to verify what really happened.

2.4 Customer Trust Erodes with Every Delay

Perhaps the most damaging cost is to your relationship with the customer. People expect fast, digital-first services. When insurance claims drag out, customers feel ignored or inconvenienced.

Waiting days for a decision — or being asked to repeat information multiple times — leads to low satisfaction scores and high churn. In fact, poor claim experiences are one of the top reasons customers switch insurance providers.

The Cost of Doing Nothing

Insurers who continue using legacy workflows may think they’re playing it safe. In reality, they’re falling behind. Not only are they spending more on labor, towing, and rentals, but they’re also missing out on loyalty and retention gains.

By contrast, photo-first claims reduce manual steps, standardize decisions, and shrink the window for fraud — all while improving the experience for the policyholder. The next section will show how this streamlined process actually works in practice.

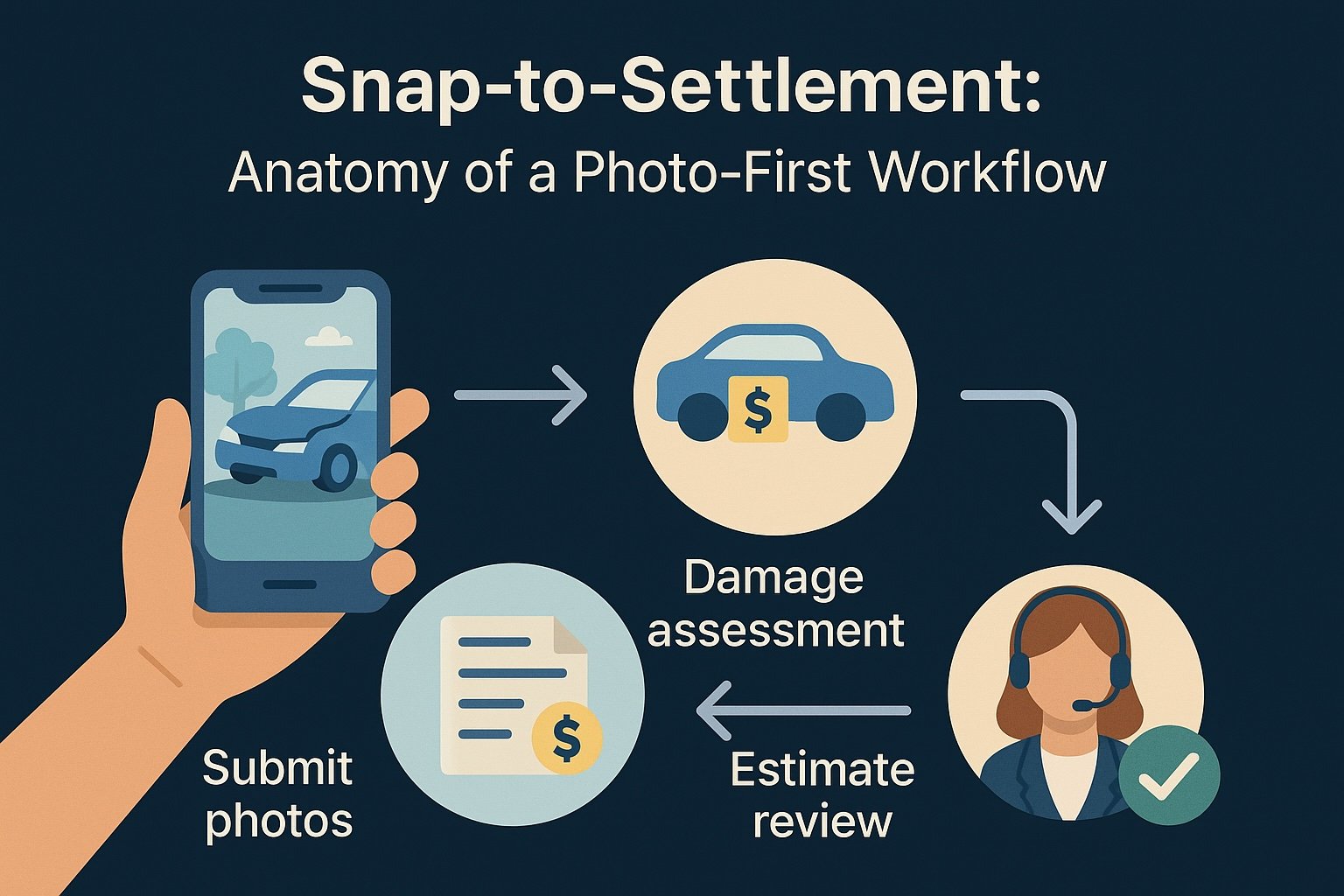

Snap-to-Settlement: Anatomy of a Photo-First Workflow

The idea behind photo-first claims is simple: let the customer take a few guided photos of the damaged vehicle and use AI to analyze those images instantly. Instead of waiting days for a human adjuster to inspect the car, insurance companies can use computer vision to assess the damage within minutes. This speeds up the entire process — from the moment the claim is submitted to the final payout.

Let’s walk through the typical steps in a photo-first claims workflow and see how each one works in practice.

Step 1: Guided Photo Capture

It all starts with the policyholder. Using a mobile app, the customer is prompted to take photos of the car from specific angles. These instructions help ensure the images are clear, well-lit, and show all necessary parts of the vehicle (front, back, sides, and any visible damage).

Some apps use real-time feedback to tell the user if the photo is blurry or missing key details. This saves time by avoiding the need to retake images later.

Step 2: Automatic Data Extraction

Once the photos are uploaded, AI steps in to extract useful information. For example:

The OCR (Optical Character Recognition) API can read the license plate or VIN number directly from the image.

The Image Anonymization API can automatically blur faces or license plates to protect personal data.

The Car Background Removal API isolates the vehicle from its surroundings, making it easier to analyze.

This automation reduces manual work and ensures that only relevant data is sent to the damage estimation model.

Step 3: Damage Detection and Localization

With the images cleaned and processed, the next step is identifying where the damage is. Here, an Object Detection API (or a custom-trained computer vision model) scans each photo to find dents, scratches, broken lights, and other common issues.

The system can label each area of damage and highlight it visually. It can also tell which part of the car is affected — bumper, hood, door, etc. — which is important for repair estimates.

Step 4: Severity Estimation and Cost Prediction

Once the damage is located, AI models analyze how severe it is. Is the bumper cracked or just scratched? Does the dent affect safety features like sensors or airbags? This level of detail helps predict the cost of repair more accurately.

In many systems, this step is powered by models trained on thousands (or millions) of previous claims. These models learn to match damage patterns with actual repair costs. In some cases, the model may even recommend a preferred repair shop or suggest whether the car is repairable or a total loss.

Step 5: Instant Estimate and Payout

After the analysis, the system automatically generates a repair estimate. This estimate can be sent to the customer for approval, passed to a repair partner, or used to process a direct payout.

Some insurers allow customers to approve the estimate with a single tap in the app. Once approved, payment can be processed instantly — sometimes on the same day the accident happened.

AI-Powered Claims in Action

Behind the scenes, many APIs can support this workflow. For example:

The Image Labelling API helps classify vehicle parts and damage types.

The NSFW Recognition API filters out inappropriate content before it reaches adjusters or automated systems.

The Logo Recognition API can detect car brands and badges, which may be useful for identifying vehicle models or verifying details.

This flexible approach means insurers can combine pre-built tools with custom logic to fit their exact needs. And because the entire process is handled in the cloud, it can scale up during busy periods — like after a storm or in peak accident seasons.

Why It Works

Photo-first claims simplify everything. Customers don’t need to schedule an inspection. Adjusters can focus on complex cases instead of routine ones. And insurers get a faster, more consistent process that reduces costs and keeps policyholders happy.

In the next section, we’ll take a closer look at the technology that powers all of this — and how insurers can build or buy the right tools for their business.

Under the Hood — Computer Vision Building Blocks That Make It Work

At the heart of photo-first claims is a set of powerful computer vision technologies. These tools allow machines to understand and interpret images — just like a human adjuster would, but faster and more consistently. To make photo-based damage estimation possible, several key components work together behind the scenes.

Let’s take a closer look at the building blocks that power this transformation.

4.1 Pre-Trained Models vs. Custom Solutions

Some AI models are trained on general data and are ready to use out of the box. These are called pre-trained models. For example, an API that detects scratches or dents on common car models might work well for many insurers right away. These pre-built tools are great for testing ideas quickly or launching pilot programs.

However, every insurer has its own needs. A company operating in a region with many electric vehicles, or with specific repair standards, may need a custom-trained model. These models are tailored using real images from that insurer’s own claims history. They can recognize unusual damage types, rare car models, or specific repair codes.

Choosing between pre-trained and custom models depends on your goals:

Pre-trained = fast start, lower cost

Custom = higher accuracy, long-term advantage

Many companies start with pre-trained APIs and gradually move to a customized solution as they scale.

4.2 Speed and Performance: Keeping It Real-Time

For photo-first claims to work smoothly, the system must process images fast — ideally in just a few seconds. This is where cloud-based APIs come in.

When a customer submits photos, they are sent to the cloud, where high-performance servers analyze them using AI models. The entire process — from upload to estimate — can happen in under 5 seconds if the system is well-optimized.

Some services also use a lightweight image quality filter at the start. This step checks if the photo is clear and complete before sending it for further analysis. If the photo is blurry or poorly lit, the app can prompt the user to retake it.

This smart filtering saves time and prevents errors further down the line.

4.3 Privacy, Security, and Compliance

Handling personal images comes with responsibility. Insurers must follow strict privacy laws, especially when operating in regions like the EU (with GDPR) or California (with CCPA).

A reliable AI system for claims must:

Anonymize sensitive data, such as faces and license plates (using an Image Anonymization API).

Encrypt all image uploads and responses to prevent unauthorized access.

Provide secure, expiring links to image results, so data isn’t exposed longer than necessary.

Offer data retention controls, so insurers can delete or archive photos based on their own policies.

These features are built into many professional-grade APIs, making it easier for insurers to stay compliant without building everything from scratch.

4.4 Scaling for Busy Seasons

Insurance claims don’t come in at a steady rate. Accidents increase during holidays, winter months, and after major weather events. A photo-first system must be able to handle sudden spikes in demand without delays.

That’s why most modern computer vision tools are deployed in the cloud with auto-scaling infrastructure. When claim volume goes up, the system automatically adds computing power. When volume drops, it scales back down — saving costs.

This flexibility means insurers can confidently use AI in both regular operations and during unexpected surges.

The Role of APIs in Fast Deployment

Instead of building every part of this system from the ground up, many insurers rely on plug-and-play APIs to speed up development. For example:

OCR API reads license plates and VIN numbers

Object Detection API finds damage areas

Car Background Removal API focuses analysis on the vehicle

Image Labelling API helps classify damage types

NSFW Recognition API blocks inappropriate content in user-submitted photos

Many of these APIs are available from providers like API4AI, which also offers custom model development for more advanced use cases. This combination of ready-to-use tools and tailored solutions allows insurers to build exactly what they need — fast, reliable, and future-ready.

In the next section, we’ll explore the real numbers: how photo-first claims deliver measurable savings, reduce fraud, and create a better experience for everyone involved.

The 40% Cost Win — Dollars & Metrics Insurers Can Bank On

Switching to a photo-first claims process isn’t just about modernizing — it’s about real financial results. Insurers that adopt AI-powered image analysis are seeing up to 40% lower handling costs per claim, along with several other measurable benefits.

Let’s break down how these savings happen and what kind of business impact you can expect.

5.1 Lower Labor and Administrative Costs

Traditional claims rely heavily on human adjusters. Each claim may require time-consuming tasks like:

Phone interviews

Scheduling inspections

Manually reviewing photos

Preparing estimates

With photo-first claims, most of these steps are automated. AI models do the heavy lifting — analyzing damage, estimating costs, and generating reports. As a result, fewer claims require human involvement, which:

Reduces the number of adjusters needed

Shortens training and onboarding time

Cuts down on human error and rework

Result: Many insurers report saving between $40 and $60 per claim in handling costs alone.

5.2 Faster Processing = Fewer Extra Expenses

Every day a claim is delayed increases the chance of extra costs:

Rental car extensions

Towing and storage fees

Temporary transportation reimbursements

Photo-first claims speed up the entire process. Some insurers settle claims in less than 6 hours, compared to several days with manual workflows. This helps reduce associated costs like rental car coverage, which can be a significant part of claim expenses.

One insurer found that reducing average processing time by just 2.3 days led to double-digit savings on car rental reimbursements.

5.3 Fraud Prevention: Shrinking the Window of Opportunity

When there's a delay between the accident and the inspection, it gives dishonest actors time to stage or exaggerate damage. AI-driven systems close this gap by analyzing photos immediately after submission.

In photo-first workflows:

Customers can submit images within minutes of the incident

AI models detect inconsistent or suspicious damage patterns

Built-in metadata (timestamp, GPS) adds an extra layer of fraud prevention

As a result, insurers report a 10%–17% drop in fraud-related losses after switching to faster, AI-supported processes.

5.4 Happier Customers, Higher Loyalty

Speed and simplicity are not just good for operations — they’re good for brand loyalty too. When claims are easy to file and resolved quickly, customers are more satisfied. This directly affects retention and reputation.

Some of the most visible improvements include:

+10 to +15 point boost in Net Promoter Score (NPS)

Fewer complaints and escalations

Higher renewal rates in competitive markets

In fact, claims satisfaction is often the #1 driver of customer loyalty in auto insurance. Fast payouts create confidence — and confidence keeps customers from switching providers.

5.5 Real-World Example

Let’s say a mid-sized insurer handles 100,000 auto claims per year. By adopting a photo-first approach:

They reduce claim handling costs by $50 per claim

Cut rental car expenses by 15%

Reduce fraud by 12%

Improve customer retention by 5%

Total potential annual savings: over $5 million, not including long-term gains from better customer retention and operational efficiency.

The Bottom Line

Photo-first claims aren’t just a “nice to have.” They’re a practical, scalable way to cut costs, improve speed, and increase trust in your brand. The numbers speak for themselves.

In the next section, we’ll explore how to get started — whether by using ready-made APIs, building your own models, or finding the right partner to guide the way.

Build-vs-Buy Playbook — Choosing the Right Road to Automation

Once insurers decide to move toward photo-first claims, the next big question is: Should we build our own AI system from scratch, or use existing tools and services?

There’s no one-size-fits-all answer. Some companies prefer full control and customization. Others want to move fast with ready-to-use solutions. In reality, many find success by combining both approaches over time.

Let’s look at the options — and how to choose the right path for your business.

6.1 Quick Wins with Ready-to-Use APIs

If your goal is to launch fast and test the waters, using pre-built APIs is a great place to start. These are cloud-based tools that can handle specific tasks like:

Detecting damage in vehicle photos

Extracting license plates or VIN numbers

Removing backgrounds to focus on the car

Blurring faces for privacy protection

Identifying car parts or brand logos

Providers like API4AI offer APIs for these exact use cases, including OCR, Car Background Removal, Object Detection, Image Anonymization, and more.

By integrating these APIs into your mobile app or backend system, you can build a working photo-first claims process without hiring a team of AI specialists or setting up complex infrastructure.

Ideal for:

Pilot programs

Testing new claim workflows

Small and mid-sized insurers

6.2 Long-Term Gains with Custom AI Solutions

While off-the-shelf tools are fast to deploy, they may not handle all your needs — especially as your business grows.

For example, you might need:

Support for rare vehicle types or regional repair standards

Deeper integration with your claims platform

Custom rules for evaluating damage severity

AI models trained on your specific historical claim data

In this case, building a custom AI solution gives you more control and accuracy. You can work with an experienced partner, like API4AI, that offers custom development services. This allows you to train models that reflect your exact requirements and business logic.

Yes, custom development requires more time and investment. But over the long run, it can deliver better performance, higher automation rates, and a real competitive edge.

Ideal for:

Large insurers with high claim volumes

Regional or specialized providers

Teams aiming to build unique, brand-specific experiences

6.3 Hybrid Approach: The Best of Both Worlds

Many insurers start with pre-built APIs and transition to custom models over time. This hybrid approach allows them to:

Move fast without long setup times

Learn from real usage data

Identify gaps that need custom solutions

Gradually improve the system without disrupting current operations

For example, you might begin with:

Object Detection API to highlight damage

Image Quality API to reject blurry photos

Anonymization API to ensure compliance

Then, after analyzing 6–12 months of claims, you could train a custom model to predict repair costs more accurately based on your own regional pricing data.

This way, you’re not starting from zero — but you're also not stuck with generic tools forever.

6.4 What to Look for in an AI Partner

Whether you buy, build, or combine both, choosing the right AI provider matters. Here are key features to look for:

Fast, reliable APIs with clear documentation

Data privacy compliance (GDPR, CCPA, etc.)

Flexible pricing (pay-per-call, volume-based, or enterprise licensing)

Support for custom model development

Scalability, so your system can handle peak periods

On-premise or hybrid deployment options, if required for sensitive environments

A partner like API4AI offers both plug-and-play tools and a custom development team — making it easier to evolve from simple automation to fully tailored AI workflows.

Making the Right Choice

The photo-first model is no longer a futuristic idea — it’s already changing how claims are handled across the industry. But how you implement it depends on your needs, timeline, and resources.

Whether you start small with ready-made APIs or build a fully customized solution from day one, the important part is starting. Every step you take toward automation brings cost savings, faster settlements, and happier customers.

In the final section, we’ll bring everything together and look at what the future holds for AI-powered claims.

Conclusion – Settling Claims at the Speed of the Customer

The insurance industry is going through a quiet revolution — and it’s powered by photos. What used to take days or even weeks — inspections, approvals, payouts — can now happen in just a few hours with the help of AI and computer vision.

We’ve explored how photo-first claims work, what technologies make them possible, and why they offer real value for insurers and policyholders alike. From reducing labor costs and preventing fraud to improving customer satisfaction and retention, the benefits are clear. Many insurers are already seeing up to 40% lower handling costs, along with faster settlement times and fewer complaints.

Behind these results are practical tools — like OCR, object detection, background removal, and damage localization APIs. Companies like API4AI make these tools accessible, offering both ready-to-use solutions and custom development services that can adapt to any insurer’s needs. Whether you’re launching a pilot program or building a long-term strategy, these AI-powered components help speed up the claims process while keeping it accurate and secure.

The best part? You don’t have to rebuild your entire system overnight. Many insurers start with simple API integrations and scale over time, moving toward a more advanced, automated workflow step by step.

Looking ahead, the future of claims is likely to become even smarter. New AI models will combine image analysis with other data sources — like written accident descriptions or sensor data from vehicles — to make even better decisions. We may soon see fully automated claims that don’t just respond to an incident, but help prevent fraud and optimize repairs before the vehicle even reaches the shop.

In a world where customers expect everything to be fast and digital — from shopping to banking to healthcare — insurance must keep up. Photo-first claims are not just a new trend. They’re a new standard.

The question for insurers today isn’t “should we adopt photo-first?” — it’s “how fast can we get started?”