30-Second Onboarding: IDs to CRM Automatically

Introduction — Why 30 Seconds Is the New Gold Standard

In today’s digital economy, time isn’t just money — it’s conversion, retention, and reputation. Customers no longer tolerate long forms, document upload delays, or manual identity verification. They expect seamless onboarding, ideally completed in the time it takes to scan a QR code or tap a fingerprint. For C-level executives, this shift isn’t cosmetic — it represents a fundamental change in how customer acquisition funnels generate revenue.

Research shows that over half of users abandon digital onboarding flows that take more than 60 seconds. For regulated industries like banking, insurance, and telecom, where customer onboarding includes identity verification and KYC (Know Your Customer) compliance, that presents a real challenge — but also a significant opportunity. The question is no longer if onboarding should be accelerated, but how to deliver that speed without compromising compliance, accuracy, or security.

The solution lies in automation powered by AI. By leveraging modern computer vision and OCR (Optical Character Recognition) technologies, it’s now possible to instantly extract verified data from documents such as passports, driver’s licenses, or utility bills — all from a simple photo taken on a mobile device. That data can then be parsed, validated, and pushed directly into your CRM, ERP, or onboarding platform. What once took minutes (and often manual effort) can now happen in under 30 seconds.

This transformation isn’t limited to user experience. Faster onboarding leads to measurable business outcomes: reduced customer acquisition costs, lower abandonment rates, and faster time-to-revenue. It also improves data accuracy and reduces operational overhead by eliminating the need for human transcription or post-submission verification.

For executives focused on digital transformation, customer lifetime value, and operational efficiency, automated onboarding is more than a UX upgrade — it’s a strategic lever. This blog post explores the technological landscape, implementation paths, and business impacts of fully automated onboarding. The end goal: turning identity documents into verified CRM entries in 30 seconds or less, without sacrificing compliance or control.

The Hidden Cost of Form Friction — Revenue, CAC & Brand Equity

Every additional second a new customer spends on your onboarding form increases the risk they never finish it. This isn’t just a UX issue — it’s a strategic business problem with direct financial consequences. For C-level leaders, form friction quietly erodes revenue, inflates Customer Acquisition Cost (CAC), and undermines brand trust.

Studies show that each extra field in a digital form reduces completion rates by 2–4%. In high-stakes environments like finance, healthcare, or telecom — where onboarding includes identity verification, proof of address, and regulatory consent — users often face a maze of document uploads, manual data entry, and confusing instructions. This results in abandonment rates upwards of 60% for digital KYC processes. These are not just lost conversions; they represent lost marketing spend, delayed pipeline revenue, and decreased ROI on product development.

Form friction also inflates operational costs. When customers make mistakes — typos, incomplete uploads, mismatched details — support and compliance teams must intervene. This adds manual overhead, slows down activation, and creates a backlog that strains internal resources. Worse, it exposes companies to regulatory risks if errors slip through the cracks.

But the damage isn’t only financial. The onboarding experience is a customer’s first meaningful interaction with your brand, and it sets the tone for the relationship. Clunky, repetitive forms signal bureaucracy and inefficiency — even if the product behind the wall is best-in-class. In contrast, smooth, automated onboarding communicates precision, trustworthiness, and innovation.

CROs and CMOs are beginning to treat onboarding friction not as a design flaw, but as a critical leakage point in the revenue funnel. CFOs, too, are recognizing that cutting days or even minutes off the onboarding process yields faster revenue recognition and improved cash flow. And from a CEO perspective, the shift toward automation aligns with broader transformation goals — scaling growth while controlling cost and risk.

The competitive advantage is clear: organizations that remove friction by auto-extracting data from photos of IDs or utility bills can offer a radically better experience while capturing more value per lead. The next sections will show how this is not only achievable, but deployable within weeks using cloud-native tools.

From Pixels to Verified Profiles — How Auto-Extraction Works

At the core of 30-second onboarding is a simple but powerful idea: instead of asking users to fill out form fields manually, let the document speak for itself. Today’s AI-driven image processing pipelines can take a smartphone photo of a passport, driver’s license, or utility bill and convert it into verified, structured customer data — automatically and in real time.

This process, known as document data auto-extraction, consists of four key stages, each powered by advanced computer vision and AI.

1. Document Detection and Preprocessing

The first step begins the moment a user uploads or captures an image. AI models identify and isolate the relevant document from the background — even if it’s skewed, tilted, or partially obstructed. Glare, blur, or uneven lighting? Modern preprocessing pipelines can normalize the image to ensure high data quality. This makes the system robust across real-world conditions and diverse mobile devices.

2. Optical Character Recognition (OCR)

Once the document is cleanly extracted, OCR APIs take over. These services convert visual text — names, dates, addresses, ID numbers — into machine-readable data. Unlike legacy OCR tools that struggled with fonts, poor lighting, or handwriting, today’s cloud-native OCR solutions are trained on vast datasets, enabling high accuracy across multiple languages, fonts, and layouts. The output is a structured dataset (typically in JSON), ready for use across CRM, KYC, and analytics systems.

3. Intelligent Parsing and Validation

Raw text is not enough. AI-powered parsers map the extracted data to standardized fields: first name, last name, document type, issue date, expiry date, etc. More sophisticated systems can detect context — for example, distinguishing a billing address from a mailing address, or spotting missing mandatory fields. Validation layers can cross-check formats, verify date logic (e.g., expiry must be in the future), and flag anomalies in real time.

4. Optional Risk and Compliance Checks

For industries that require fraud prevention or regulatory compliance, additional AI layers can be added. Face matching compares the ID photo with a selfie for biometric confirmation. Tamper detection checks for signs of image manipulation or forged documents. Cross-document consistency can ensure, for example, that the name on a utility bill matches the ID provided. These steps can be deployed instantly or triggered selectively based on risk scoring rules.

This entire flow can be completed in seconds — faster than most users can manually fill out their name and date of birth. More importantly for business leaders, the experience is both frictionless for users and compliant for enterprises.

Behind the scenes, this is made possible by a modular architecture of cloud APIs and AI microservices. Organizations can mix and match ready-to-use components, such as OCR APIs, with custom-built validators tailored to their industry or geography. This flexibility enables rapid deployment while allowing deep control over accuracy, compliance, and data flow.

The result? A high-trust, high-speed onboarding process that turns user-uploaded images into actionable, verified customer records — with zero manual effort.

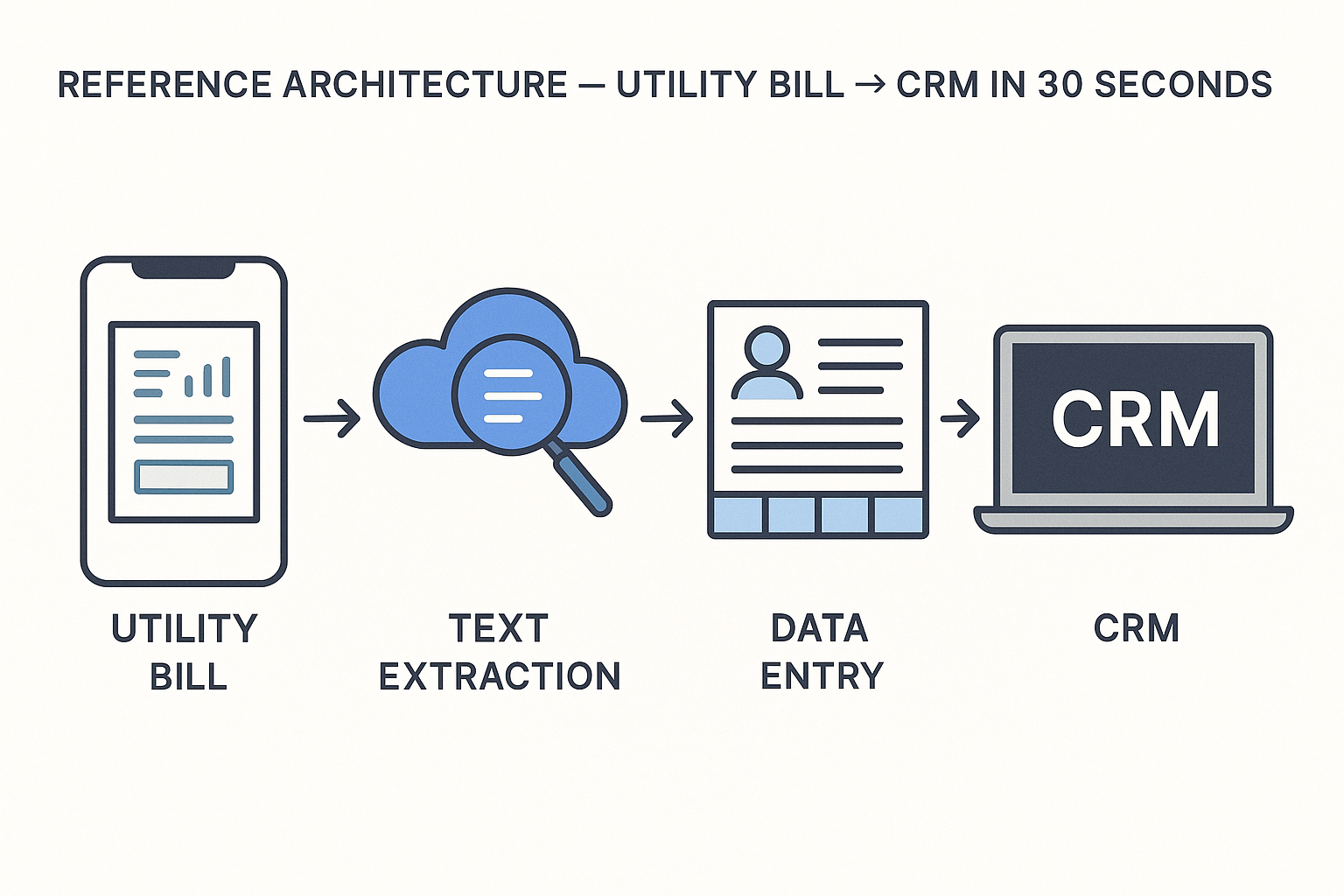

From Utility Bill to CRM in 30 Seconds — A Modern Architecture in Action

The promise of “photo-to-CRM” onboarding isn’t theoretical — it’s already being implemented by digital-first organizations that prioritize speed, security, and scale. Behind this rapid experience is a modular, cloud-native architecture that seamlessly connects mobile input, AI-powered processing, and backend integration. For C-level executives, understanding this architecture is essential for evaluating feasibility, risk, and long-term ROI.

Let’s walk through how a customer might onboard using a utility bill — one of the most common forms of address verification in regulated industries.

Step 1: Image Capture and Compression

The journey starts when a customer photographs their utility bill using a smartphone or uploads a scanned document via a web interface. A lightweight client-side SDK detects the document’s edges, ensures correct alignment, and compresses the image for secure transmission. This step is optimized for performance even on low-end devices or limited network connections, ensuring accessibility across diverse user segments.

Step 2: Real-Time OCR and Data Extraction

As soon as the image reaches the backend, it’s handed off to a high-speed OCR API, which converts the visual content into structured data. This includes customer name, address, account number, billing date, and issuing utility provider. Multilingual support ensures compatibility with global document formats, and advanced text recognition handles both typed and handwritten fields — an essential feature for utility bills in emerging markets.

Step 3: Smart Parsing, Validation, and Enrichment

Once extracted, the raw data undergoes intelligent parsing. Field-specific logic identifies and organizes key-value pairs, such as matching the correct postal code format or verifying that the billing date is recent enough to qualify for KYC requirements. Optional enrichment services can supplement the data using third-party sources — for instance, verifying that the address exists or the utility provider is legitimate.

Step 4: Decision Layer and Compliance Checks

Depending on the use case, additional business rules may be applied. For example, a mismatch between the customer’s declared address and the one on the utility bill might trigger a request for a second document or escalate the case to manual review. High-trust use cases may also include fraud scoring or flagging suspicious patterns, such as altered documents or reused templates.

Step 5: CRM Integration and Customer Activation

Finally, once the document is validated and all fields are confirmed, the structured data is pushed into the CRM, onboarding platform, or identity verification system via a secure API. The customer is now registered — with verified address and identity — and can proceed to access products, services, or further personalization workflows.

From start to finish, this flow can be completed in under 30 seconds — even faster when the system is fine-tuned for the organization’s specific document types and compliance needs.

Crucially, this architecture is scalable, secure, and modular. Businesses can start with out-of-the-box OCR APIs and expand to custom-built components over time. This allows for rapid prototyping and deployment, while still supporting long-term strategic goals like deeper automation, regional document support, and full integration into enterprise IAM or customer data platforms.

For CTOs, CIOs, and compliance heads, this setup checks the boxes: robust audit trails, encrypted data flows, API-based scalability, and the flexibility to operate in hybrid or private cloud environments. For CMOs and CROs, it means fewer drop-offs, faster time to revenue, and a smoother onboarding experience that builds trust from the very first interaction.

Business Impact — Metrics the CFO & CRO Care About

Speeding up onboarding isn’t just about convenience — it directly improves core financial and commercial metrics. For CFOs, CROs, and CMOs, the transition from manual or semi-automated processes to a fully AI-powered document onboarding pipeline translates into measurable and repeatable business outcomes. The shift from form-filling to auto-extraction improves both top-line growth and bottom-line efficiency.

1. Increased Conversion Rates and Revenue Uplift

Every abandoned onboarding session is a missed revenue opportunity. By eliminating friction through instant document capture and auto-fill, businesses consistently report conversion rate improvements of 15–30%. In industries with high customer lifetime value (CLV), even a single-digit lift in conversions can generate substantial top-line growth. The faster a customer completes onboarding, the sooner they reach activation — whether that means opening an account, making a purchase, or starting a subscription.

2. Lower Customer Acquisition Cost (CAC)

When onboarding is slow or complex, more marketing spend is needed to compensate for the drop-off. By streamlining the flow with automated document recognition, businesses reduce the number of leads lost between click and conversion. This lowers CAC and allows sales and marketing teams to reinvest saved budget into higher-yield channels or new customer segments. Over time, this creates a compounding efficiency effect across the acquisition funnel.

3. Faster Revenue Recognition and Time-to-Value

Manual verification processes often delay customer activation by hours or days — especially when identity checks require back-office review. By reducing the end-to-end flow to under 30 seconds, organizations can accelerate revenue recognition cycles. This is especially critical in subscription or usage-based models, where billing begins after successful onboarding. Shorter cycles improve cash flow forecasting, reduce churn risk during onboarding, and contribute to more predictable ARR/MRR growth.

4. Operational Cost Savings and Team Efficiency

AI-driven onboarding replaces repetitive, low-value tasks — such as reviewing scanned documents or correcting typos — with real-time automation. This allows compliance, operations, and customer support teams to scale without adding headcount. In some sectors, businesses have reported up to 45% reduction in document processing costs after implementing automated KYC solutions. For larger enterprises, this can result in millions in annual savings.

5. Higher Data Quality and Personalization Potential

Manually entered data is prone to errors, incomplete fields, or inconsistent formats. Auto-extracted and validated data ensures clean, structured customer records from day one. This not only reduces downstream errors but also enables more accurate segmentation, faster risk profiling, and more personalized engagement strategies — all of which improve lifetime value and retention.

6. Improved Compliance and Risk Management

Regulated industries benefit from embedded validation, fraud detection, and audit logging capabilities that come with modern AI onboarding stacks. This reduces the risk of non-compliant onboarding and minimizes exposure to fines or reputational damage. For the C-suite, this means lower risk-adjusted costs and greater resilience under growing regulatory scrutiny.

In summary, investing in AI-powered onboarding is not just a technical upgrade — it’s a strategic financial decision. When onboarding moves at the speed of a smartphone photo, the business benefits are felt across every function: from acquisition to finance, from compliance to customer experience. It’s not just about saving time — it’s about unlocking value.

Strategic Playbooks — Build, Buy, or Blend?

For executive teams tasked with modernizing onboarding, the strategic question isn’t whether to automate — it’s how to do it in a way that balances speed, control, and long-term ROI. Depending on your organization’s needs, compliance requirements, customer base, and internal capabilities, there are three primary approaches to implementing document-driven automation: Buy, Build, or Blend.

The “Buy” Strategy: Plug-and-Play APIs for Speed to Market

Organizations looking for rapid deployment and minimal technical complexity often begin by integrating ready-made OCR and document processing APIs. These tools require little to no machine learning expertise and can be embedded into mobile apps or web platforms within days. This approach is ideal for businesses that:

Work with common document types (e.g., passports, driver’s licenses, utility bills)

Operate in markets with relatively uniform compliance expectations

Need to validate an MVP or meet urgent go-to-market deadlines

The buy strategy delivers fast wins and is especially attractive to mid-sized companies that want to stay lean while improving CX and conversion. However, long-term flexibility can be limited if requirements evolve toward less common documents, regional variants, or deeper customization.

The “Build” Strategy: Full Control for High-Complexity Use Cases

Enterprises with unique document types, strict data residency rules, or advanced fraud detection needs may opt to build a custom pipeline tailored to their specific environment. This typically involves:

Designing proprietary models for layout recognition and entity extraction

Integrating biometric verification and tamper detection

Hosting infrastructure on private or hybrid clouds to meet security and compliance needs

While the build strategy requires higher up-front investment in engineering, MLOps, and data curation, it offers long-term control, differentiation, and regulatory confidence. It’s well-suited to industries like finance, insurance, healthcare, or government services — where accuracy, auditability, and compliance are mission-critical.

The “Blend” Strategy: Best of Both Worlds

For many organizations, the most effective approach is a hybrid one. A blended strategy allows teams to start fast with off-the-shelf APIs for mainstream documents while gradually layering in custom logic, risk scoring, or regional document support as business needs evolve. For example:

Use a commercial OCR API to extract passport fields

Add a custom-built module to detect fraud in local ID cards

Layer in your own validation logic for regulatory red flags or exception handling

This phased approach reduces implementation risk while allowing strategic depth over time. It also provides budget flexibility — investing more only where necessary, while benefiting from existing tools elsewhere.

Making the Right Choice for Your Business

C-level executives should evaluate the trade-offs through the lens of volume, document variability, compliance requirements, and internal technical resources. Startups and fast-moving B2C players may lean toward “Buy.” Highly regulated incumbents may invest in “Build.” Growth-stage companies and digitally mature enterprises often find the “Blend” approach offers the best balance of speed, scale, and adaptability.

Regardless of the chosen path, one fact is clear: AI-powered document automation is no longer a moonshot — it’s an operational necessity. Executives who act early can capitalize on lower CAC, faster onboarding, and superior customer experience, while those who wait risk falling behind both in growth and compliance readiness.

Conclusion — Turning Seconds into Lifetime Value

Onboarding is no longer just a back-office function — it is a front-line driver of growth, efficiency, and brand perception. In today’s competitive digital landscape, the difference between a 30-second and a 3-minute onboarding process can mean the difference between a converted customer and a lost opportunity. For the C-suite, that gap translates into measurable impact on CAC, LTV, churn, and time-to-revenue.

Thanks to advances in AI-powered image processing, computer vision, and OCR technologies, it's now possible to convert identity documents — such as passports, driver's licenses, or utility bills — into verified, structured CRM records in real time. What once required manual input and days of verification can now happen in under 30 seconds, without compromising on compliance, accuracy, or user experience.

This is not just a user convenience; it’s a strategic business lever. Automated onboarding lowers operational costs, reduces abandonment rates, improves data quality, and accelerates revenue recognition. Just as importantly, it communicates to customers that your brand is modern, secure, and easy to do business with — a differentiator that increasingly influences purchasing decisions in B2C and B2B markets alike.

For executive teams, the path forward is clear:

Audit your current onboarding process. Where do users drop off? How much manual effort is required behind the scenes?

Quantify the business impact of delay — in revenue, risk, and cost of acquisition.

Decide on the right strategic model: Buy, Build, or Blend, based on your document types, risk profile, and growth stage.

Act quickly, starting with high-impact, low-complexity improvements such as integrating off-the-shelf OCR APIs.

In a market where every second counts, turning onboarding into a competitive advantage is no longer optional — it’s a mandate. The technology is here. The ROI is proven. And the organizations that act decisively will not only capture more customers — they’ll earn their trust from the very first interaction.

By making onboarding invisible, you make the value of your product visible — faster.