Invoice Chaos to Cash Flow: Payables on Autopilot

Introduction — From Manual Mayhem to Cash Flow Clarity

Accounts payable (AP) is no longer just a back-office function — it’s a strategic lever. In today’s economy, where margins are thin, capital is expensive, and forecasting accuracy is under the microscope, finance leaders can’t afford to treat invoice processing as an afterthought. Yet for many enterprises, AP remains stuck in a digital dark age.

Invoices still arrive as email attachments or scanned PDFs. Staff manually extract purchase order numbers, due dates, totals, and line items — often rekeying data into ERP systems or spreadsheets. Approval routing happens via inbox ping-pong. Payments are delayed, vendor relationships strained, and early-payment discounts left on the table.

This manual sprawl isn’t just inefficient — it’s a threat to cash-flow visibility, compliance, and operational agility. According to industry benchmarks, the average cost to process a single invoice manually can range from $12 to $35. But beyond direct costs, the lack of real-time insight into payables creates blind spots that can distort budget tracking, obscure procurement trends, and weaken financial controls.

The solution? Intelligent automation powered by AI and computer vision.

Modern Optical Character Recognition (OCR) technology, trained on thousands of invoice formats, can now “read” scanned documents as effectively as a human — at a fraction of the time and cost. It extracts structured data like PO numbers, tax IDs, and due dates directly from PDFs, even when layouts vary across vendors. When combined with automated workflows and ERP integration, this creates a touchless pipeline from invoice intake to payment execution.

But the true value for CFOs and COOs lies in what this automation unlocks:

Real-time spend visibility across departments, categories, and vendors

Reduced processing costs and faster cycle times

Access to early-payment discounts, improving working capital

Stronger compliance through audit trails and approval tracking

This blog post explores how AI-powered OCR — like the one offered through API4AI’s cloud-based APIs — can turn accounts payable from a liability into a cash-flow catalyst. We’ll walk through the hidden costs of manual AP, the technologies that enable automation, and the business outcomes that matter most to executive teams.

It’s time to move from invoice chaos to payables on autopilot.

The Hidden Price of Manual Accounts Payable

At first glance, invoice processing may seem like a routine operational task — low priority, low impact. But for enterprises managing thousands of invoices per month, the cost of doing it manually adds up fast — and in more ways than one. The real price of manual accounts payable (AP) is not just labor or errors; it’s lost opportunities, financial blind spots, and strategic drag.

Operational Inefficiencies That Compound Over Time

Manual AP processes are slow, error-prone, and inconsistent. Employees must open email attachments, visually scan invoices for key details, and manually enter them into finance systems. Each step is a potential failure point — missed line items, incorrect PO numbers, or misrouted documents. Delays in approvals often mean invoices go unpaid until they escalate, triggering late fees and friction with vendors.

Duplicate invoices are another silent killer. Without intelligent systems in place, finance teams may process the same invoice twice or pay for goods never received, leading to revenue leakage that’s difficult to recover or even detect.

Strategic Risk from Lack of Visibility

Perhaps more damaging than processing inefficiencies is the lack of real-time visibility into outstanding liabilities. CFOs and finance directors need a clear, up-to-date view of committed spend, cash outflows, and upcoming payment obligations. But when invoice data is buried in inboxes, spreadsheets, or disconnected tools, forecasting becomes guesswork.

This creates cascading problems: inaccurate accruals on financial statements, limited agility in cash-flow planning, and missed insights into vendor performance or maverick spending. The inability to surface real-time data weakens the organization’s decision-making muscle — precisely when it’s needed most.

Reputational and Relationship Impact

Vendors notice when payments are consistently late or communication is delayed. This weakens trust and can damage supply chain resilience. In competitive markets, it also reduces your leverage. Suppliers are more likely to offer favorable terms, discounts, or priority service to buyers who pay on time and provide a frictionless experience.

A Competitive Disadvantage in the Making

While some organizations continue to rely on manual AP, others are gaining an edge by automating their invoice intake, approval, and payment workflows. They’re not just reducing costs — they’re unlocking strategic benefits: tighter financial control, improved vendor relationships, and the ability to act on spend insights in real time.

In a landscape where efficiency is a strategic differentiator, manual accounts payable isn’t just outdated — it’s expensive. And as we’ll see in the next section, AI-powered OCR is no longer a futuristic luxury — it’s a practical, proven way to eliminate this hidden cost.

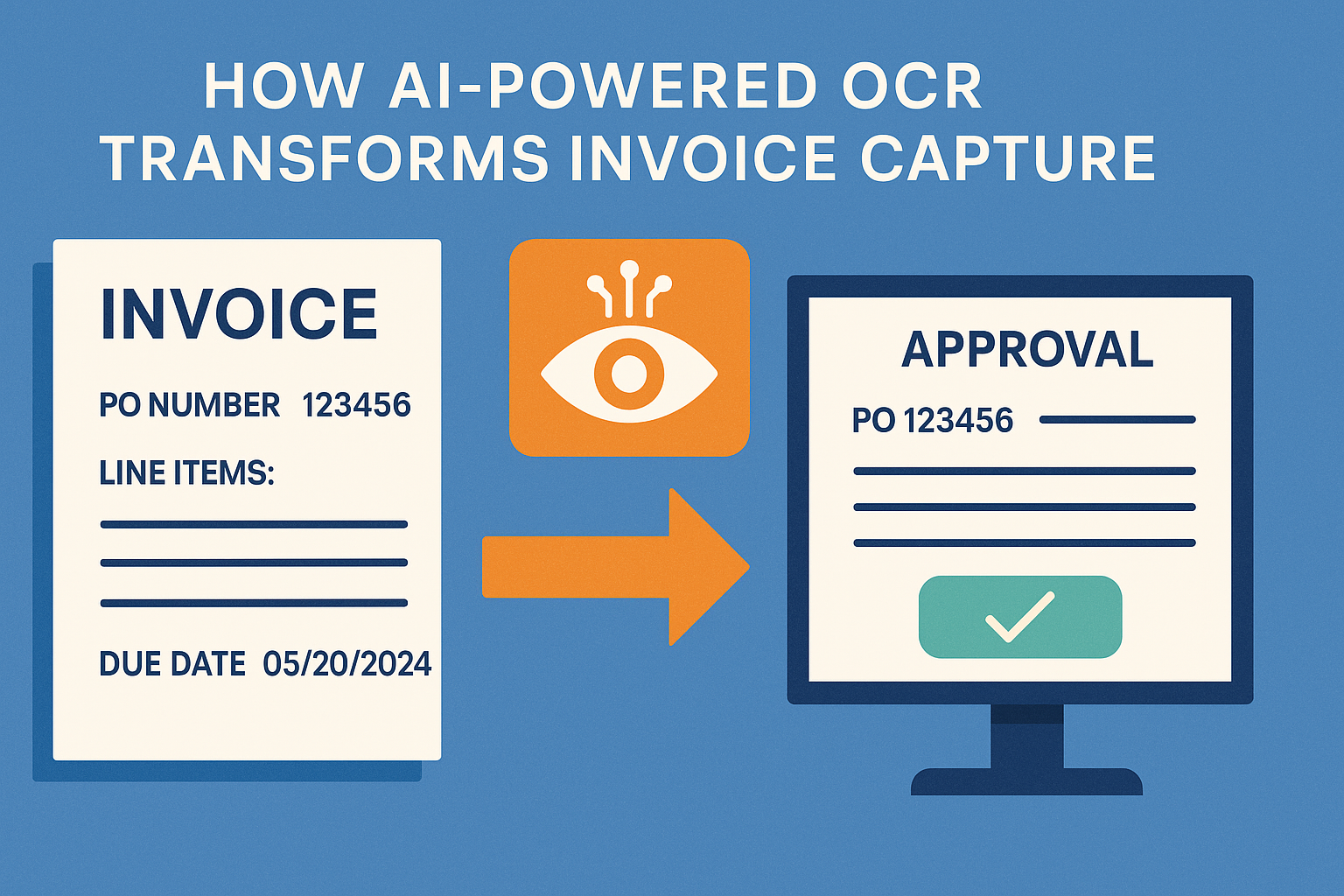

How AI-Powered OCR Transforms Invoice Capture

The cornerstone of automated accounts payable is the ability to turn unstructured documents — PDFs, scans, and photos of invoices — into structured, machine-readable data. This is where AI-powered Optical Character Recognition (OCR) delivers breakthrough value. Unlike legacy OCR tools that depend on static templates, today’s advanced OCR uses computer vision and deep learning to interpret invoices with human-level accuracy, regardless of format, layout, or language.

From Static Files to Actionable Data

Invoices rarely follow a single standard. Each supplier may use a different layout, terminology, or sequence of information. Traditional automation systems struggle with this variability, requiring manual setup and constant maintenance.

Modern AI-driven OCR, by contrast, is trained on diverse invoice types from multiple industries and countries. It recognizes not just text, but context — understanding where to find purchase order numbers, invoice dates, line items, payment terms, tax IDs, totals, and due dates, even when scattered across the page. It also detects multi-page invoices, variable-length tables, and handwritten annotations.

For example, API4AI’s OCR API can ingest a PDF or image and return structured data points such as vendor name, invoice number, subtotal, and payment terms — all within seconds. This creates a clean digital input for further automation in your accounts payable pipeline.

Built-in Intelligence and Error Handling

Beyond simple text extraction, intelligent OCR models assign confidence scores to each field, helping detect anomalies like missing invoice numbers or mismatched totals. These signals can trigger exceptions or approval workflows, preventing errors before they cascade into financial systems.

The models also support multiple languages and currencies, enabling global finance teams to process invoices from international vendors without additional manual effort. This is particularly valuable for enterprises with regional offices or distributed procurement functions.

Seamless Integration with AP Workflows

OCR is not a standalone solution — it’s the front door to end-to-end automation. When connected with workflow engines and ERPs, it enables touchless invoice processing. Invoices can be scanned or forwarded via email, captured instantly, and routed to the right approvers without a single keystroke.

Instead of backlogs, inbox chases, or delayed entries, finance teams gain a steady stream of clean, verified data — ready for approval, reconciliation, and payment.

Beyond OCR: Enriching the AP Stack

While OCR handles document intelligence, other AI capabilities — such as object detection, image anonymization, and label recognition — can support related use cases like verifying attached receipts, masking sensitive data, or identifying vendor-specific branding on packaging or documents. These tools, available through unified API platforms like API4AI, allow organizations to expand automation beyond invoices and into broader procurement and finance workflows.

In short, modern OCR is not just a faster way to scan documents — it’s a foundational enabler of real-time, scalable, and intelligent accounts payable operations. By digitizing invoice data at the source, companies can lay the groundwork for seamless automation and deeper financial insight.

Autonomous Workflow: From Approval to ERP

Extracting data from invoices is only the beginning. The real transformation happens when that data flows seamlessly through your organization — triggering approvals, enforcing controls, and updating core financial systems without human intervention. This is where automation shifts from operational convenience to strategic value.

Smart Approval Routing That Keeps Things Moving

Once OCR extracts key fields — such as total amount, department code, and vendor ID — workflow engines take over. Instead of relying on email threads or informal approvals, the system applies intelligent routing logic based on your business rules.

For example, marketing invoices over $10,000 might automatically be sent to the department head and then the CFO. If no action is taken within 48 hours, the system can escalate the request or send a reminder via Microsoft Teams, Slack, or mobile notifications. This prevents invoices from stalling in inboxes, reducing the risk of late payments and improving cycle times.

Approval workflows can also be enriched with contextual data: past invoices from the same vendor, contract terms, budget status, or project codes — empowering managers to approve or reject with full visibility.

Touchless Matching and Validation

One of the biggest hurdles in traditional AP is the manual matching of invoice data with purchase orders (POs) and goods receipt notes (GRNs). AI-enabled systems can now perform two-way (invoice to PO) or three-way (invoice to PO and GRN) matching automatically.

If an invoice aligns perfectly with what was ordered and received, it’s eligible for automatic posting and payment — no manual review required. If discrepancies arise (e.g., quantities or prices don’t match), the system flags the issue for investigation before any funds move.

This not only accelerates the payment process but also reinforces financial controls, ensuring the business pays only for what was ordered and delivered.

Seamless ERP Integration

Once approved, the invoice data is pushed into your ERP system — whether that’s SAP, Oracle, Microsoft Dynamics, or another platform — without requiring a data entry team. This reduces manual workload and eliminates the risk of transcription errors that can distort ledgers, delay reporting, or trigger audit issues.

Finance leaders can also benefit from real-time dashboards that aggregate AP data from across systems and geographies. This visibility allows treasury, FP&A, and procurement teams to see where money is going — and where value might be unlocked.

Built-In Compliance and Audit Readiness

CFOs and controllers are under increasing pressure to ensure that financial processes are not just efficient, but auditable and compliant. Autonomous workflows provide built-in logging and traceability. Every step — from document capture to approval and payment — is recorded with user identity, timestamp, and action.

When combined with privacy-enabling tools like API4AI’s Image Anonymization API, organizations can also redact sensitive personal or financial data where necessary, ensuring alignment with data protection regulations such as GDPR, HIPAA, or industry-specific standards.

The Strategic Advantage

By orchestrating invoice approvals, matching, validation, and ERP updates within a single automated pipeline, businesses eliminate bottlenecks, minimize risk, and position their finance function as a driver of agility.

For C-level executives, this means faster close cycles, better cash management, and fewer surprises when financial reports hit the boardroom. Automation isn’t just about doing things faster — it’s about gaining the control, visibility, and responsiveness needed to compete in today’s financial landscape.

C-Suite Payoff: Real-Time Spend & Early-Payment Discounts

Automating accounts payable isn’t just about efficiency gains — it’s a strategic upgrade that directly impacts the balance sheet, income statement, and cash-flow position. For C-level executives, the shift to AI-driven invoice processing unlocks a suite of financial and operational advantages that extend well beyond the back office.

Real-Time Spend Visibility

Manual AP processes leave finance leaders operating with lagging indicators. Budgets are updated after the fact, accruals rely on guesswork, and surprise variances often surface only at quarter-end. Automation changes this dynamic completely.

With AI-powered OCR extracting invoice data the moment it enters the system — and autonomous workflows feeding that data directly into dashboards — CFOs gain a live view of committed and actual spend. By department, by vendor, by project. This allows finance teams to:

Spot budget overruns before they happen

Flag non-compliant or maverick spending in real time

Make informed decisions about deferrals, re-allocations, or approvals based on accurate current-state data

For COOs, this visibility extends into operational performance. Which suppliers consistently overbill? Which departments process invoices the slowest? These are no longer anecdotal questions — they become measurable metrics with accountability.

Working Capital Optimization Through Early-Payment Discounts

Many vendors offer early-payment discounts — often 1 to 3 percent for paying within 10 days instead of 30 or 60. Yet most organizations miss out on this opportunity because their invoice processing cycles are too slow or unpredictable.

With automation accelerating approvals and matching, invoices become eligible for early payment within hours — not weeks. This enables AP teams to prioritize which invoices to fast-track based on available cash, discount windows, or supplier importance.

Over time, these small percentages compound into significant financial impact — especially in industries with thin margins or large vendor ecosystems. Treasury teams can also incorporate these flows into liquidity planning, reducing the need for short-term borrowing.

Stronger Procurement and Vendor Strategy

Automated AP provides clean, timely data that procurement leaders can use to renegotiate contracts, track supplier performance, and ensure adherence to payment terms. This strengthens vendor relationships and improves leverage in future negotiations.

Vendors prefer working with customers who pay on time and communicate transparently. Becoming that kind of customer builds loyalty, reduces churn, and can unlock strategic benefits like priority allocation or favorable terms — especially during supply chain disruptions.

Enhanced Financial Control and Predictive Power

With structured invoice data feeding directly into analytics platforms, FP&A teams can move from descriptive to predictive insights. Forecasting becomes sharper. Scenario planning becomes faster. And boardroom reporting gains precision and confidence.

Executives can also track spend-to-budget ratios in near real-time, align cash disbursements with revenue cycles, and model the financial impact of accelerated payments or cost containment strategies.

Bottom-Line Impact That Matters

Ultimately, automated accounts payable isn’t just a process improvement — it’s a profit enabler. Reduced processing costs, captured discounts, improved forecasting, and tighter financial control all contribute to EBITDA uplift and valuation resilience.

For C-level stakeholders, this means transforming AP from a passive cost center into a proactive cash-flow engine — one that supports strategic growth, M&A readiness, and enterprise agility in a volatile economy.

Implementation Roadmap & Build-vs-Buy Considerations

For many C-level executives, the biggest question is not whether to automate accounts payable — it’s how. Should the organization adopt off-the-shelf APIs to achieve quick wins? Or invest in a tailored solution to accommodate more complex workflows, formats, and long-term needs?

The answer often lies in aligning technology choices with the company’s current maturity, data landscape, and strategic goals. Here’s how to think about the roadmap.

Start Small, Scale Smart

The most successful AP automation initiatives begin with a focused pilot — often within a single business unit, region, or vendor set. The objective isn’t to solve every edge case upfront, but to prove ROI quickly. This agile approach allows teams to test integrations, measure processing time improvements, and identify exceptions before rolling out at scale.

By leveraging ready-to-use APIs — such as API4AI’s OCR API — companies can start ingesting invoices within days, not months. These tools offer robust functionality out-of-the-box, including multi-language support, key field extraction, and confidence scoring, without the need for complex model training or infrastructure setup.

When to Go Custom: Complex Workflows and Enterprise Scale

While off-the-shelf APIs are ideal for rapid deployment, certain organizations require more customized solutions. For example:

You receive invoices in highly variable or proprietary formats across multiple subsidiaries

Your process includes adjacent documents like receipts, delivery notes, or customs declarations

You need deep integration with multiple internal systems, including ERP, procurement, and contract databases

You operate in regulated industries with specific compliance and audit traceability demands

In these scenarios, partnering with a provider that offers custom AI development services — like API4AI — can ensure that your solution fits your exact operational needs. Custom pipelines can be trained on your real data, optimized for edge cases, and designed with long-term total cost of ownership (TCO) in mind.

A tailored solution may require more initial investment, but it often pays off through better automation coverage, fewer manual interventions, and seamless alignment with enterprise governance standards.

Integration & Change Management

Technology alone doesn’t deliver ROI — people and process alignment do. As automation is introduced, it’s critical to define clear ownership, align stakeholders across finance, IT, and procurement, and provide transparent training and communication.

Finance teams must trust the outputs of AI systems. That means starting with transparency: visibility into extracted fields, audit trails for decisions, and override mechanisms where necessary. Building that trust accelerates adoption and reduces friction.

A phased rollout — beginning with mid-risk invoices and progressing to high-value or multi-departmental flows — allows for controlled scaling and performance tuning.

KPI Tracking & Continuous Optimization

From the outset, define the success metrics that matter to the C-suite:

Invoice cycle time

Percentage of touchless processing

Discount capture rate

Processing cost per invoice

Exception rate and approval delays

Modern AP platforms — and cloud-based APIs integrated with analytics dashboards — enable real-time tracking of these KPIs. This feedback loop is essential for continuous improvement and executive-level visibility.

A Strategic Investment, Not a Tactical Patch

Ultimately, automating accounts payable is not just about removing paperwork — it’s about unlocking strategic agility. Whether you choose plug-and-play APIs or a fully customized computer vision solution, the investment delivers dividends in visibility, control, and working capital efficiency.

For forward-looking finance teams, this isn’t a question of automation vs. status quo — it’s a decision about building a smarter, faster, and more resilient organization. And it starts by choosing the right roadmap.

Conclusion — Turning AP Automation into Strategic Advantage

For decades, accounts payable has been treated as a back-office function — necessary, but rarely strategic. That mindset no longer holds. In a business environment defined by rising capital costs, supply chain fragility, and pressure for real-time financial intelligence, AP is emerging as a critical lever for cash optimization, operational resilience, and enterprise agility.

By replacing manual invoice processing with AI-powered automation, finance leaders can unlock measurable business value:

Real-time visibility into spend that improves forecasting and budgeting accuracy

Faster invoice cycle times that reduce late fees and operational drag

Captured early-payment discounts that directly enhance EBITDA

Automated controls and audit trails that mitigate risk and ensure compliance

Scalable digital infrastructure that adapts as the organization grows

These are not marginal gains. They are competitive advantages.

Thanks to advances in computer vision and deep learning, today’s OCR solutions can accurately extract structured data from virtually any invoice — regardless of format, language, or quality. When combined with workflow automation and ERP integration, they enable a truly touchless AP process, reducing costs and freeing finance teams to focus on strategic priorities.

Whether you choose to start with fast, ready-to-deploy APIs — like the OCR API from API4AI — or develop a fully customized computer vision solution tailored to your specific AP workflows, the path forward is clear: automation is not a technical upgrade; it’s a business transformation.

For C-level decision makers, the time to act is now. Invoice chaos doesn’t have to be a cost of doing business. With the right strategy and technology, it becomes an engine of cash flow, insight, and control.

From PDF to payment in minutes — not weeks. That’s payables on autopilot.