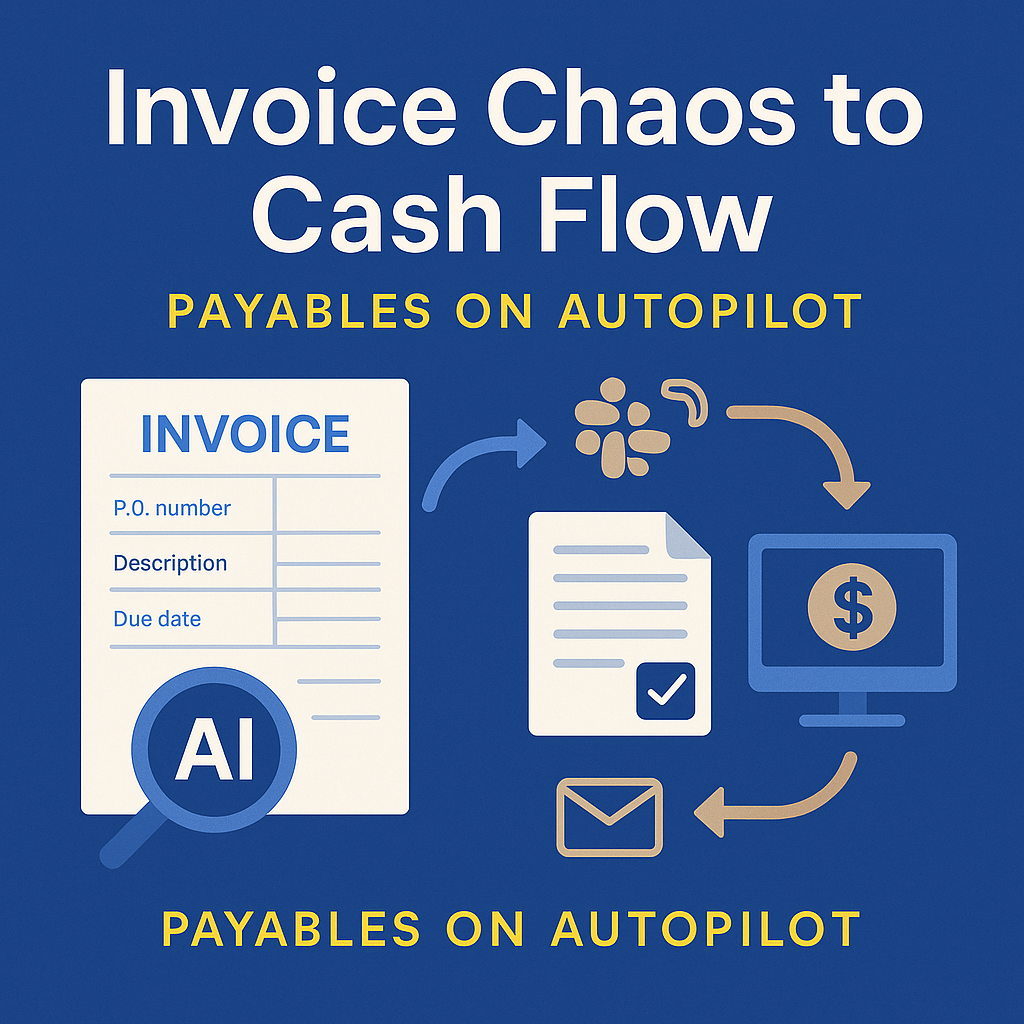

Invoice Chaos to Cash Flow: Payables on Autopilot

Manual invoice processing is more than a back-office burden — it’s a silent drain on cash flow, efficiency, and strategic visibility. This post explores how AI-powered OCR and automated workflows can transform accounts payable from a chaotic, error-prone function into a real-time, touchless system. Discover how finance leaders are cutting costs, capturing early-payment discounts, and gaining complete control over spend — without reinventing their tech stack.

Expense Reports: Turning Receipts into Data

In a world where finance leaders demand speed, visibility, and control, manual expense reports are still slowing everyone down. But with modern AI-powered OCR, receipts can be transformed into structured data in seconds — no spreadsheets, no delays. This blog explores how forward-thinking organizations are using automation to unlock real-time insights, enforce compliance, detect fraud, and turn expense reporting into a strategic asset, not a back-office burden.

AI APIs for Finance & Banking: 2025 Use Cases & Benefits

In 2025, artificial intelligence is no longer a futuristic add-on in finance — it’s becoming the core engine behind secure, efficient and customer-friendly operations. AI-powered computer vision is playing a critical role in automating document processing and fraud detection, replacing manual bottlenecks with lightning-fast, scalable workflows. From extracting data from ID documents to verifying faces and signatures, these technologies help banks onboard customers faster, prevent fraudulent activities and maintain full compliance with global regulations. In this blog post, we explore how ready-to-use AI APIs and custom vision solutions are helping financial institutions modernize their operations, reduce costs, and deliver exceptional user experiences — while staying one step ahead of emerging fraud threats and rising regulatory demands.

AI OCR API: Reducing Costs in Financial Document Processing

Financial institutions handle vast amounts of paperwork daily, from invoices and loan applications to tax reports and compliance documents. Manually processing these documents is time-consuming, error-prone and costly. AI-powered Optical Character Recognition (OCR) is transforming financial workflows by automating data extraction, improving accuracy and ensuring compliance — all while significantly reducing operational expenses.

This article explores how AI-driven OCR surpasses traditional document processing methods, enhances efficiency in key financial operations like invoice management and KYC procedures, and integrates seamlessly with existing financial systems. With the ability to scale according to business needs, AI-powered OCR not only cuts costs but also unlocks long-term profitability. Whether adopting ready-to-use OCR APIs or investing in custom AI solutions, financial institutions that embrace automation today will gain a competitive edge in the evolving digital landscape.

Top AI Trends Shaping the Finance Industry in 2025

Artificial intelligence is rapidly transforming the finance industry, revolutionizing fraud detection, customer interactions and investment strategies. With AI-powered predictive analytics, real-time data processing and intelligent automation, financial institutions can operate more efficiently, reduce risks and provide hyper-personalized services.

From automated document processing with OCR to AI-driven fraud prevention and risk assessment, machine learning models are optimizing financial workflows and enhancing security. Meanwhile, conversational AI is redefining customer service, offering 24/7 support and tailored financial advice. In investment and trading, AI-driven sentiment analysis and predictive analytics are helping fund managers and traders make smarter, data-backed decisions.

As financial firms navigate an increasingly digital landscape, the choice between ready-to-use AI solutions and custom-built models becomes crucial. While off-the-shelf APIs can streamline operations, tailored AI developments provide long-term competitive advantages, ensuring businesses stay ahead of emerging market trends.

The future of finance belongs to institutions that embrace AI strategically, leveraging its power to drive efficiency, security and customer satisfaction. Those who act now will set new industry standards, shaping a smarter and more adaptive financial ecosystem.