Ambush Alert: Spotting Off-Contract Logos in Seconds

Introduction — The New Compliance Clock Speed

Global sponsorship spend is expected to top US $65 billion in 2025 — and a growing share of that money hinges on category exclusivity clauses that promise brands they will be the only logo in view during premium moments (Straits Research). Yet at every World Cup, Olympic Games, or Grand Prix, clever competitors still slip unauthorized signage into camera frames or fan zones, hoping to “borrow” the spotlight without paying the rights fee.

The practice — called ambush marketing — isn’t just a PR nuisance; it is treated as a breach of contract by organizers and can trigger fines, make-good airtime, or even litigation. The International Trademark Association notes that ambush strategies range from subtle hashtag campaigns to full-blown on-site intrusions that confuse viewers about official sponsorship status (International Trademark Association). Regulators and rights holders, from the IOC to the U.S. Olympic & Paralympic Committee, have become significantly more aggressive in enforcement, citing the need to protect multimillion-dollar sponsorship packages (Reuters).

For CFOs and CROs, the math is simple: every minute a rogue logo remains visible erodes contractual value and undermines renewal leverage. According to rights-valuation consultancies, a single high-definition camera angle at a major final can deliver tens of thousands of dollars in media value per exposure second. Multiply that by a two-minute delay in spotting and removing illegal signage, and six-figure losses emerge before the next whistle.

Until recently, closing this “visibility gap” meant hiring armies of human spotters or reviewing footage after the fact — both too slow for live broadcasts or social streams. Advances in real-time computer-vision APIs now change the equation: brand-recognition models can scan every frame of a multi-camera feed, flag off-contract marks in under two seconds, and push an alert (with bounding-box evidence) directly to venue operations or broadcast control. With latency measured in **seconds — not hours — **compliance shifts from retrospective policing to proactive risk prevention.

Executive takeaway: Ambush marketing has evolved into a real-time threat, but the tools to neutralize it have caught up. Organizations that embed instant logo-detection and alerting into their event workflows protect sponsorship revenue, reduce legal exposure, and signal governance maturity to their partners — all without adding headcount.

The Business Case — What Off-Contract Logos Really Cost

Brand exclusivity is not a soft metric; it is a line item on the P&L. Independent valuations peg a courtside logo in a prime-time broadcast at US $3,000–$6,000 per exposure second, depending on camera angle and audience size. A two-minute window in which a rogue banner remains visible can therefore drain well over US $500,000 in media value before anyone reaches for the gaffer tape. For sponsors that now negotiate deals on cost-per-exposure-second (CPeS) benchmarks, every unlicensed second dilutes ROI and erodes the rate card for next season. See this concise sponsorship valuation guide for typical pricing methodologies (CHARGE | Sponsorship Agency).

The direct cash impact is only part of the downside. Rights agreements typically include breach-of-exclusivity clausesthat obligate venues to provide make-goods — extra screen time, discounted renewals, or outright refunds — if an ambush incident is not resolved within a contract-defined service-level window (often measured in minutes). Failing that SLA can trigger contractual penalties or litigation, as illustrated by recent Rule 40 enforcement actions at the Olympics, where unauthorized brand activity risks fines, takedown orders, and public naming-and-shaming by organizers. A brief primer on Rule 40 obligations is available in this legal overview.

Beyond immediate financial exposure lie three strategic risks that boardrooms cannot ignore:

Renewal leverage: Sponsors scrutinize incident history before re-upping multi-million-dollar deals. A single televised breach can slash renewal probability, forcing rights holders into price concessions.

Brand trust and reputation: Frequent ambush incidents signal weak controls and may prompt blue-chip advertisers to redirect budgets to more secure properties.

Operational drag: Manual review teams, legal counsel, and crisis-PR retainers balloon overhead whenever enforcement remains reactive rather than proactive.

Executive takeaway: Treat ambush-marketing incidents as measurable revenue leaks with legal accelerants. By quantifying exposure seconds, breach-penalty triggers, and sponsor churn risk, CFOs and CROs can build a hard-dollar case for investing in real-time detection and alerting — often recovering the spend in a single averted incident.

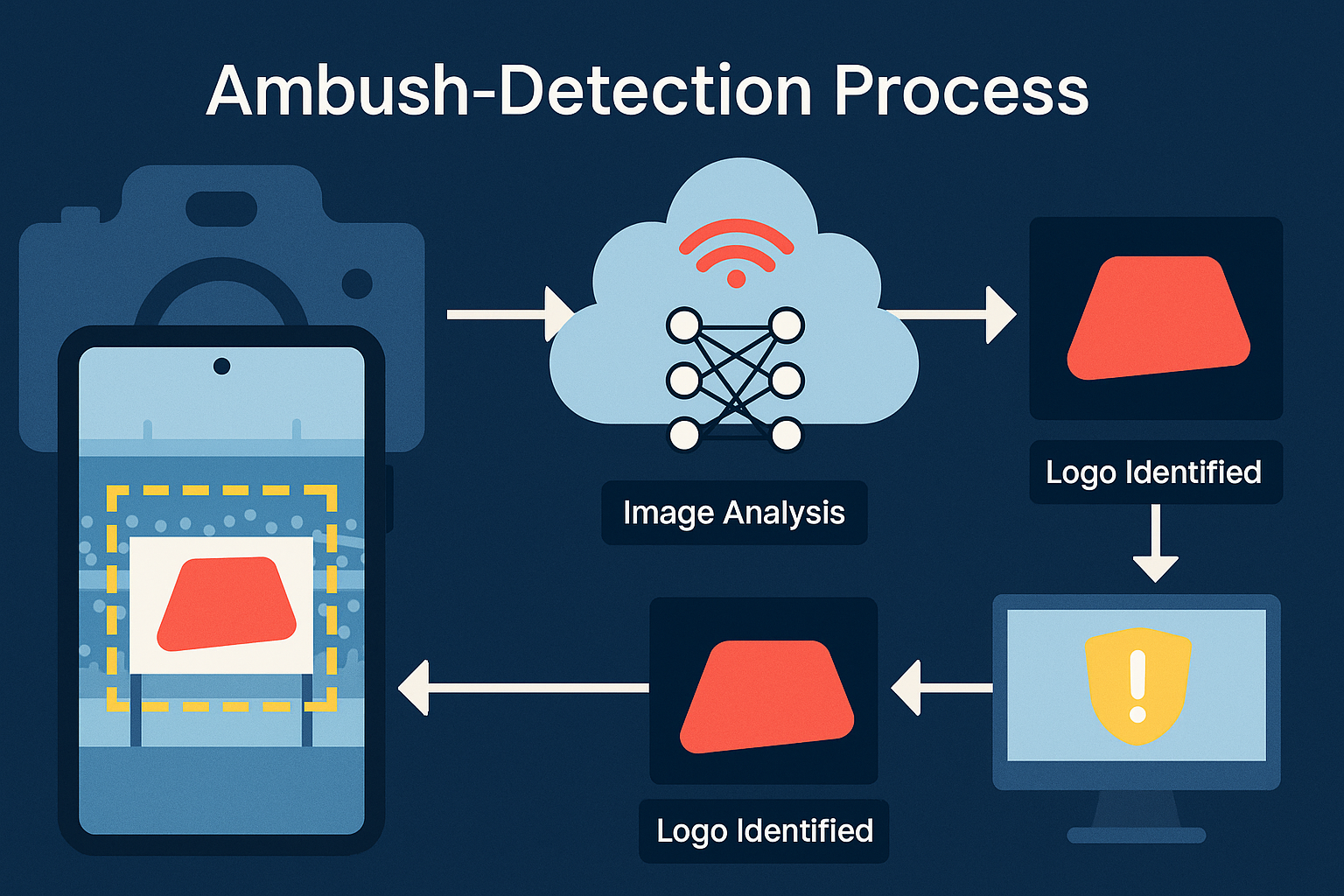

How Ambush-Detection Works — From Pixels to Live Compliance

Modern ambush-detection systems behave like a virtual security team patrolling every broadcast pixel. They ingest dozens of camera feeds, social-media clips, and in-venue screens, then apply layered computer-vision checks to spot unauthorized marks before they harm contractual value. Here’s how the pipeline translates technology into real-time risk control:

1. Multi-feed capture. Stadium CCTV, OB-truck outputs, and even crowd-sourced smartphone videos are pulled into a unified stream hub. Smart frame-sampling keeps processing loads predictable without missing fleeting signage flashes (for example, adaptive 12–30 fps on low-activity angles, full 50 fps on panning shots).

2. AI vision stack.

Brand Recognition API pinpoints logos — including obscured, angled, or partial marks — across thousands of brand classes. Leading engines now process HD frames in under two seconds, even at broadcast scale.

OCR API reads banner text or jersey slogans to flag text-based ambush attempts.

Object Detection API adds scene context (billboards, apparel, digital boards), reducing false positives.

Image Anonymization API automatically blurs faces or license plates so compliance footage can be archived without privacy risk.

3. Decision engine. Detection scores flow into a rules layer that checks persistence (e.g., appears in three consecutive frames), confidence thresholds, and “negative lists” of non-sponsor brands. Only qualified incidents trigger alerts, avoiding alarm fatigue for operations teams.

4. Real-time alerting. Within seconds of spotting an off-contract logo, the system pushes a clip, bounding box, and zone coordinates to venue staff via mobile push, radio dispatch, or control-room dashboards. A 2025 field test showed time-to-action improvements of 92 % compared with human spotters alone.

5. Continuous learning. Confirmed incidents — both true and false — feed back into model retraining queues. When venues host atypical brands or regional sponsors, API4AI offers custom model extensions so accuracy climbs rather than plateaus over the season.

For C-level leaders, the takeaway is clear: combining ready-to-use vision APIs with a thin orchestration layer turns logo compliance into a live, SLA-driven capability. A recent deep-dive on this architecture can be found here for additional context: Real-Time Logo Detection: Live-Stream Sponsorship ROI (medium.com).

From Alert to Action — The 10-Second Playbook

When a rogue logo surfaces on a LED board or a fan banner, speed is governance. UEFA’s “clean-stadium” rules, for example, oblige clubs to keep every centimetre of the commercial zone free of unauthorised branding and give organisers the right to remove or cover infringing marks immediately (documents.uefa.com). Failing to act can void exclusivity clauses and expose the venue to breach penalties that run into the mid-six figures, as recent ambush disputes have shown (gowlingwlg.com).

1. Trigger (0-2 s).

Real-time vision APIs monitor all live feeds and social clips. The moment an off-contract mark clears confidence and persistence checks, the system packages a five-second clip, bounding box coordinates and a probability score.

2. Notify (2-4 s).

An automated webhook pushes the incident to the Venue Compliance channel — simultaneously lighting up the steward’s handheld, the broadcast control dashboard and the security desk. Role-based controls ensure only authorised staff can act or dismiss.

3. Act (4-10 s).

Front-line stewards or floor managers receive the exact seat, row or board location. They either remove the physical banner, drape an approved cover or, for digital overlays, instruct the AV operator to switch feeds. Broadcast directors can also cut to an alternate angle while the issue is fixed, preserving sponsor value in the live stream.

4. Verify & Close (10-20 s).

Cameras rescan the zone; if the mark is gone for three consecutive frames, the alert auto-closes. Persistent sightings escalate to legal/commercial teams in real time.

5. Audit & Learn (end of match).

Each incident is logged with time-stamps, exposure seconds avoided and response time. Monthly roll-ups feed board-level KPIs and retrain detection models, so edge-case false positives shrink over the season.

Executive takeaway: A lightweight, API-driven playbook turns ambush response into a high-confidence SLA, protecting sponsorship revenue in less time than it takes to complete a replay.

Deployment Choices — Pilot Fast, Scale Stadium-Wide

Choosing where the pixels are processed is the most strategic decision you’ll make. Latency, bandwidth, privacy, and total cost of ownership shift dramatically depending on whether the intelligence sits in the cloud, at the edge, or in a hybrid of the two.

Edge-first for sub-second response.

Private multi-access edge computing (MEC) nodes placed inside — or immediately outside — the venue cut round-trip latency to the 20 ms range, enough to trigger an alert before the camera operator finishes a slow pan. A recent AWS reference deployment with Verizon private 5G illustrates how on-prem MEC keeps data local, satisfies sovereignty rules, and eliminates the “upload tax” on high-bit-rate video (Amazon Web Services, Inc.). Edge nodes can run compressed inference pipelines, forward only incident clips to the cloud, and remain operational even if the back-haul link drops.

Cloud-hybrid for elastic scale.

Conversely, cloud video analytics services — such as Microsoft’s Live Video Analytics on IoT Edge — offer autoscaling, built-in GPU pools, and a familiar DevOps toolchain. They ingest a lower-frame-rate proxy stream from each camera while reserving burst capacity for sell-out events, then return JSON alerts or webhook payloads to the control room. This model reduces on-site hardware but adds ~200–300 ms of network latency — acceptable for most compliance SLAs and ideal for multi-venue roll-outs managed from a single NOC (Microsoft Learn).

Data-policy fundamentals.

Whichever architecture you choose, retain only incident clips; delete or anonymize everything else. Coupling the pipeline with Image Anonymization APIs keeps GDPR regulators satisfied without slowing response times.

Integration touchpoints.

Video-management systems: ingest RTSP or SRT feeds directly.

Broadcast switchers: auto-cut to an alternate angle when a violation fires.

Workforce comms: push rich alerts to Slack, MS Teams, or radio dispatch.

Ticketing/CRM: tag incidents to the sponsor record for make-good audits.

Accuracy operations.

Start with out-of-the-box Brand Recognition and OCR models; add custom training only for niche regional brands or unusual lighting conditions. Continuous feedback from confirmed incidents raises precision without breaking the rollout schedule.

Security guardrails.

Use signed webhooks, VPC peering, and least-privilege IAM roles; encrypt all stored clips. Edge nodes should run in a locked-down container runtime and report health metrics to a central dashboard.

30-60-90 pilot blueprint.

Day 0–30: Cover a single high-risk zone (e.g., courtside LED boards); measure precision, false positives, and median time-to-alert.

Day 31–60: Expand to multi-zone coverage, integrate broadcast switch automation, and finalize incident-report templates for sponsors.

Day 61–90: Roll out stadium-wide, enable auto-scaling across concurrent events, and lock KPIs into the venue’s commercial SLAs.

Executive takeaway: Edge and cloud are not an either-or choice; treat them as interchangeable gears in the same drivetrain. Start with the architecture that clears your latency and data-residency hurdles, then layer on the APIs and custom models that will future-proof exclusivity enforcement for the next rights cycle.

Board Math — The ROI of Real-Time Ambush Prevention

Sponsorship is not a branding after-thought; it is a US $65 billion global line item forecast for 2025, with signage and on-screen visibility representing the single largest revenue slice for rights holders (Straits Research). Every second of exposure therefore has a measurable cash value, increasingly priced by many properties using Cost per Exposure Second (CPeS)or similar media-equivalency models. In other words, lost exclusivity is lost revenue — no abstractions required.

The alpha equation.

At board level, the ROI case simplifies to three levers:

Loss avoidance: Prevented exposure seconds × agreed CPeS rate + contractually defined breach penalties. A sponsor paying $4,000 per on-air second will cost the venue over $240 k if an off-contract banner stays visible for just one minute.

Revenue protection: A clean incident record boosts renewal probability and preserves rate-card integrity; rights consultants estimate that a single high-profile breach can shave 10–15 % off the next-season deal.

Operational efficiency: Automated vision cuts human monitoring headcount, legal hours, and make-good production costs — often recovering its annual subscription in the first avoided incident.

Threshold economics. Sponsors themselves benchmark success at a minimum 2-to-1 ROI, expecting at least two dollars in quantifiable benefit for every dollar invested in rights (SponsorCX). By logging time-to-alert, exposure seconds avoided, and make-good dollars saved per incident, real-time detection pipelines provide the transparent, auditor-ready data needed to prove that ratio — or better — every season.

KPIs for the next board packet:

Prevented incidents per event

Median time-to-remove (seconds)

Compliance SLA adherence (%)

“At-risk exposure” trend line (rolling 12 months)

Sponsor renewal uplift versus historical average

When those metrics feed a monthly dashboard, finance and commercial teams can model the uplift on renewal deals and the hard savings on make-goods — turning compliance from a cost centre into a profit-preservation function.

Executive takeaway: With a clear formula and hard KPIs, real-time ambush detection pays for itself faster than almost any capital project on the event tech roadmap — and it safeguards the pricing power of every future sponsorship contract.

Conclusion — Make Compliance a Real-Time Capability

Ambush marketing has evolved from a sporadic nuisance into a predictable, high-value threat that can be neutralised within seconds — if the right technology and workflows are in place. Rule-40 enforcement at recent Olympics and other marquee events shows that regulators and rights holders will not hesitate to levy penalties or demand costly make-goods when unauthorized branding slips through (Knobbe Martens). At the same time, advances in vision AI now enable sub-second logo recognition across dozens of simultaneous feeds, turning what was once an end-of-day audit into a live, SLA-driven safeguard for sponsorship revenue (Aim Technologies).

For C-level leaders, three imperatives stand out:

Pilot quickly, measure ruthlessly. Cover a single high-risk zone with ready-to-use APIs — starting with a Brand Recognition API for logos, OCR for text-based ambushes, and anonymization for privacy. Capture metrics such as time-to-alert and prevented exposure seconds from day one.

Embed compliance into operations, not legal aftercare. Route real-time alerts to venue staff and broadcast control so rogue signage is removed before contracts are breached. Automate audit trails so finance and legal teams can close incidents and demonstrate value without manual footage review.

Scale with tailored intelligence. Each venue, sport, and sponsor roster is unique. Extending off-the-shelf models with custom training — whether to recognise regional brands or adapt to challenging lighting — turns the system from a generic filter into a strategic asset that preserves exclusivity season after season.

Bottom line for the board: real-time ambush detection is no longer an experimental add-on; it is a revenue-protection layer that pays for itself in a single avoided incident, safeguards sponsor renewal leverage, and signals governance maturity to every commercial partner. The organisations that act now will lock in the competitive advantage of uncompromised brand exclusivity while their rivals are still combing through yesterday’s footage.