Sharper Inspections & Appraisals: Focus on the Vehicle

Introduction — Why Image Isolation Changes the Math

When your teams judge vehicle condition from photos, every distraction — parking-lot clutter, people in frame, busy signage, harsh shadows — adds noise to a decision that should be simple. Background removal does one thing exceptionally well: it isolates the vehicle so reviewers compare like-for-like angles, see defects without hunting for them, and move from subjective debate to objective evidence. For trade-ins, rentals, and insurance claims, that shift translates into faster cycle times, fewer disputes, and tighter financial control.

What “image isolation” really means for the business

Standardized evidence, not prettier pictures. By removing backgrounds and normalizing capture angles, your organization creates a consistent evidence set — front-left vs. front-left, wheel vs. wheel — so pricing, grading, and approvals become repeatable across locations and partners.

Shorter time-to-decision. Appraisers and adjusters spend less time reconciling inconsistent photos and more time making calls that stick. That reduces rework, escalations, and back-and-forth with customers.

Lower leakage and dispute rates. Clear, comparable images make it easier to defend charges on rental turnbacks, align trade-in offers to reality, and resolve claim severity faster — with an audit trail that stands up to scrutiny.

Operational scale without more headcount. A lightweight, API-first pipeline slots into existing capture apps and back-office systems, improving throughput while keeping processes governable.

Better customer experience. Clear visuals and consistent outcomes build trust. Customers see what you see.

Why now

Remote and asynchronous workflows are the norm. Whether it’s a dealer appraising a vehicle off-site or a renter documenting a return after hours, decisions depend on photos, not in-person inspections.

AI vision quality crossed a threshold. Modern models can isolate cars precisely, preserve realistic shadows/reflections, and auto-flag poor shots before they reach reviewers.

Regulatory and reputational pressure increased. Clean, standardized imagery supports compliant archiving, fair treatment, and rapid investigations when questions arise.

How it fits your stack (at a glance)

At capture: mobile guidance enforces a fixed set of angles and checks for glare/blur.

In processing: a vehicle-aware background removal step strips distractions and centers the car; optional part detection crops rims, glass, and panels for closer review; OCR extracts VINs and tags; anonymization protects faces and plates.

At decision: reviewers get like-for-like comparisons and auto-highlighted differences, then push outcomes to appraisal, rental, or claims systems with SLA tracking.

A pragmatic starting point

Leaders don’t need a big-bang rewrite to see impact. Many organizations begin by inserting a single step — car-specific background removal — into their photo flow, then layer on detection, OCR, and anonymization as KPIs improve. If you prefer proven building blocks over custom R&D, solutions like API4AI’s Car Image Background Removal API provide that first acceleration; you can expand with complementary APIs (OCR, object detection, anonymization) or commission tailored models later as your edge cases emerge.

Bottom line for the C-suite

Isolating the vehicle turns messy, inconsistent vehicle inspection photos into decision-grade car appraisal images. The result is faster, cheaper, and more defensible judgments across trade-ins, rentals, and claims — without asking your teams to work harder. This is an execution play with immediate ROI and a clear runway for compounding value as you standardize angles, automate checks, and industrialize damage assessment.

The Problem Statement — Real-World Photos Aren’t Decision-Grade

Most organizations already collect thousands of vehicle inspection photos. The problem isn’t quantity — it’s quality for decision-making. Uncontrolled capture conditions turn “evidence” into opinion, forcing experts to reconcile inconsistent images before they can appraise value, assign liability, or approve repairs. That friction shows up as cycle-time delays, pricing variance, and avoidable disputes.

Symptoms you see on the P&L

Longer cycle times: reviewers waste minutes per case aligning angles, zooming, and requesting re-shoots. Across trade-ins, rentals, and claims, that compounds into days of delay.

Pricing and grading variance: two locations can produce different outcomes on the same car because the photos aren’t comparable. Variance erodes margin and confidence.

Higher dispute and write-off rates: customers argue charges or offer values when images are ambiguous. Ambiguity favors the dispute.

Loss adjustment expense and rework: adjusters and appraisers bounce cases back for “better pictures,” multiplying touchpoints and overhead.

Compliance exposure: faces, license plates, and bystanders in frame create privacy risk and limit how images can be shared or archived.

Root causes in the field

Background clutter and distractions: lots, signage, people, and reflections pull attention away from the vehicle’s condition.

Angle inconsistency: one store captures front-left at 30°, another at 50°, wheels half out of frame; comparisons turn into guesswork.

Lighting variability: harsh sun, shade bands, wet panels, and over/under-exposure hide scratches and dents or exaggerate them.

Partial or low-quality shots: blur, cut-off bumpers, or lens dirt; near-duplicate images crowd the set while key views are missing.

Device and format drift: mixed cameras, aspect ratios, and resolutions complicate downstream tooling and side-by-side review.

Manual retouching: well-intentioned edits introduce bias and compromise evidentiary integrity.

Where the risk shows up (by workflow)

Trade-ins and remarketing: non-standard car appraisal images lead to wider price bands and unexpected reconditioning variances after purchase.

Rental intake/return: inconsistent before/after sets make damage assessment feel subjective, inflating chargebacks and goodwill credits.

Insurance claims (FNOL → settlement): unclear insurance claim photos fuel supplements, cycle-time creep, and arbitration risk.

Why “more training” doesn’t fix it

You can teach staff to “take better photos,” but turnover, weather, locations, and time pressure reintroduce variability. Without automated controls, the system depends on the best-case behavior of the busiest people in the least predictable environments.

What decision-grade imagery actually requires

Isolation of the subject: the vehicle must be centered and free from distracting backgrounds so defects and condition are unmistakable.

Standardized angles: like-for-like views (e.g., a defined 8–12-angle set) that make comparisons objective across sites and time.

Quality gates at capture: automated checks to block blur, glare, cut-offs, or missing views before submission.

Panel-level visibility: consistent crops for high-risk areas — wheels, bumpers, glass, lights — to reduce “I can’t see it” debates.

Privacy by default: automatic redaction of faces and plates so images can move through workflows without legal friction.

Clean metadata and lineage: trustworthy timestamps, device data, and hashes so evidence stands up to audit.

Executive takeaway

Today’s photos are plentiful but not decision-grade. Until imagery is isolated, standardized, and governed, leaders will continue paying a “friction tax” in time, margin, and customer trust. Solving this at the source — during capture and processing — turns visual proof into reliable inputs for faster, defensible approvals and valuations.

Business Outcomes by Use Case (Trade-ins, Rentals, Claims)

Background removal and angle standardization do more than make vehicle inspection photos look tidy — they change financial outcomes. Below are the three highest-leverage workflows where isolating the vehicle and enforcing like-for-like views turn subjective images into defensible car appraisal images and insurance claim photos.

Trade-ins & Remarketing — tighter price bands, faster turns

Business goal: Compress appraisal cycle time while reducing variance between stores and appraisers.

How image isolation helps: When each inbound vehicle is photographed against a neutral, consistent backdrop and a fixed 8–12-angle set, reviewers compare “front-left vs. front-left,” “wheel vs. wheel,” and spot panel defects without hunting. That shrinks deliberation and narrows price bands across locations.

Operational playbook:

Enforce a guided capture flow (pose prompts, glare/blur checks) and car-specific background removal to remove distractions.

Auto-crop high-risk areas (wheels, bumpers, glass) using object detection so recon needs are visible up front.

Extract VIN/stock tags via OCR to eliminate manual entry and mis-matches.

What to measure: appraisal turnaround time, price variance across rooftops, recon delta (pre- vs. post-recon), dispute rate at offer.

Payoff you can expect: shorter time-to-offer, fewer escalations, steadier gross per unit — without adding headcount.

Rentals & Fleet Turnbacks — fewer disputes, quicker readiness

Business goal: Reduce chargeback friction and get vehicles back into “available” status faster.

How image isolation helps: Clean, standardized before/after sets remove ambiguity. Neutral backgrounds, centered vehicles, and panel-level crops make damage assessments feel fair and repeatable to customers and auditors.

Operational playbook:

Mandate the same angle set at pickup and return; block uploads that fail blur/glare or miss a required angle.

Use background removal to neutralize lots, signage, and bystanders; apply image anonymization to faces and plates so photos can be safely shared in disputes.

Highlight diffs automatically between pre- and post-rental sets to guide agent review.

What to measure: dispute rate and win rate, average recovery time on damages, out-of-service hours, customer satisfaction after billing.

Payoff you can expect: faster decisions at the counter, fewer goodwill credits, more time on road per asset.

Insurance & Claims (FNOL → Settlement) — faster triage, lower leakage

Business goal: Accelerate cycle time while cutting supplements and improving Special Investigations Unit (SIU) signal quality.

How image isolation helps: For first notice of loss, standardized, isolated imagery speeds severity grading and routing (repair vs. total). Part-level crops make hidden damage less likely to surprise later. Clear images reduce adjuster back-and-forth and provide defensible evidence in arbitration.

Operational playbook:

Require a guided capture sequence with instant quality gates; reject non-compliant frames at source.

Apply vehicle-aware background removal to center the subject; run object detection to generate panel tiles; leverage OCR to read policy numbers, VINs, or claim IDs from tags and documents.

Use anonymization by default to meet privacy policies and ease sharing across repair networks.

What to measure: claim cycle time by severity, supplement frequency and cost, LAE per claim, arbitration outcomes, SIU referrals triggered by inconsistencies.

Payoff you can expect: quicker, more accurate severity decisions; fewer surprises mid-repair; improved recovery and compliance posture.

The API-first building blocks (illustrative)

Start small and expand as KPIs improve. Many teams begin with the Car Image Background Removal API to standardize imagery, then layer:

Object Detection / Image Labelling to auto-crop rims, glass, lights for high-risk detail.

OCR to capture VINs and identifiers straight from the frame.

Image Anonymization so sets can move through partners and legal review without redaction overhead.

This blend of ready-to-go APIs and optional custom models keeps time-to-value short while preserving a path to tailor the system for your edge cases and brand standards.

Executive takeaway

Across trade-ins, rentals, and claims, the shift to isolated, standardized images replaces opinion with evidence. The result is faster decisions, lower dispute exposure, steadier margins, and a cleaner audit trail — delivered through modular vision capabilities you can pilot in weeks and scale across the enterprise.

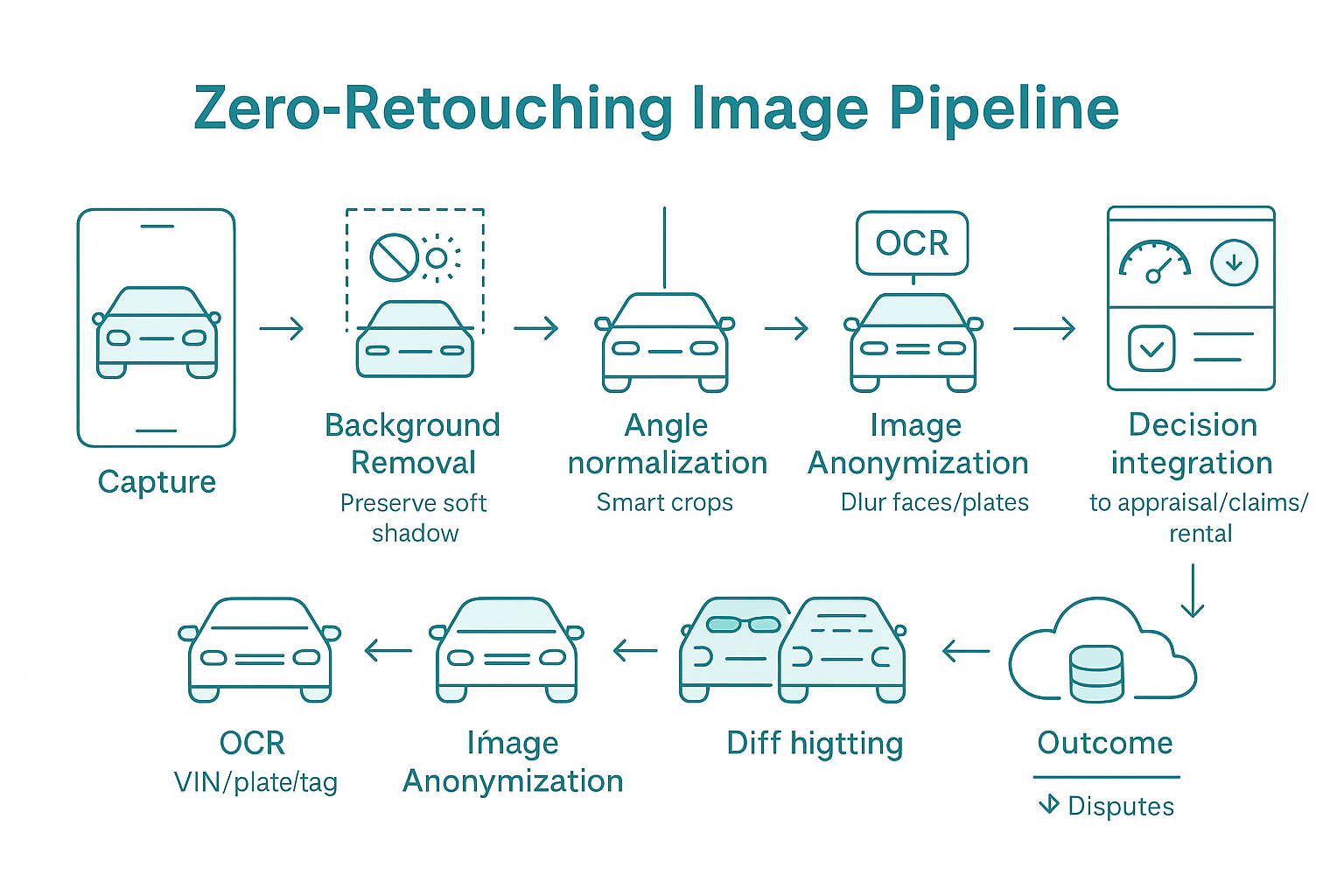

The Zero-Retouching Image Pipeline (Non-Technical Map)

A zero-retouching pipeline means decisions are powered by consistent, machine-prepared images — no manual fixes, no Photoshop, no back-and-forth for “better shots.” The flow below shows how organizations standardize vehicle inspection photos into decision-grade evidence for trade-ins, rentals, and claims.

What “zero-retouching” means in practice

Automation over artistry: every corrective action — centering, background removal, angle checks, blur/glare rejection, panel crops, VIN OCR, anonymization — happens automatically.

Evidence, not enhancement: visual realism is preserved (e.g., natural shadows), but context that adds bias or confusion is stripped away.

Instant feedback at capture: the system enforces standards before an image ever hits review, reducing rework to near-zero.

Step 1: Guided capture that enforces standards

Fixed angle set: operators are prompted through the same 8–12 views (front-left, front, front-right, rear, all wheels, glass, interior if applicable).

On-device quality gates: the app blocks submissions that are blurry, off-angle, under/overexposed, or missing required views.

Operator assist: horizon leveling, pose hints, and real-time glare alerts keep images consistent even in poor lighting or tight spaces.

Why it matters: you eliminate the #1 cause of delays — non-compliant images — at the source.

Step 2: Vehicle-aware background isolation

Remove distractions: lots, signage, people, and clutter disappear; the car is centered against a neutral backdrop.

Preserve realism: keep soft shadows and reflections so car appraisal images remain trustworthy to both customers and auditors.

Scalable unit economics: this is a millisecond-scale API call, enabling high volumes without adding headcount.

How to start fast: drop in a specialized service such as the Car Image Background Removal API to standardize imagery across locations and partners.

Step 3: Normalization & quality assurance

Pose normalization: bounding-box centering and angle estimation ensure each “front-left” actually looks like front-left.

Auto-reject and dedupe: near-duplicates and cut-off panels are filtered out; the system flags gaps in the angle set.

Metadata hygiene: timestamps, device data, geotags (where permitted), and cryptographic hashes are captured to support audit and chain of custody.

Outcome: reviewers see a clean, comparable set — no noise, no guesswork.

Step 4: Panel- and part-level visibility

Object and part detection: wheels, bumpers, glass, lights, mirrors, and high-risk zones are auto-identified.

Smart crops: the pipeline generates defect-ready tiles so reviewers can zoom straight to likely damage areas without hunting.

Consistency over time: the same regions are extracted at intake, turnback, and claim — enabling reliable before/after comparisons and dispute defense.

Step 5: Identity, safety, and compliance by default

OCR for identifiers: VINs, plates, claim IDs, stock tags, and lot stickers are read automatically, reducing keying errors and mismatches.

Privacy protection: faces and plates are blurred via Image Anonymization so images can safely traverse customer communications, partner networks, and legal reviews.

Brand and policy checks: NSFW and Brand/Logo Recognition gates keep sets compliant with corporate and marketplace rules.

Data residency controls: storage and processing can be pinned to required regions to satisfy regulatory obligations.

Step 6: Comparison, triage, and decision

Like-for-like side-by-sides: standardized angles allow instant comparisons (e.g., intake vs. return, pre-loss vs. FNOL).

Auto-highlighted differences: visual diffs and severity cues focus reviewers on what changed and where.

Workflow integration: decisions, notes, and severity grades flow into appraisal tools, rental systems, or claims platforms with SLA timers and audit logs.

Result: faster, more defensible decisions — and less escalation.

API building blocks that make this modular

Car Image Background Removal API — isolates vehicles for neutral, consistent backdrops.

Object Detection / Image Labelling APIs — find panels and parts; generate smart crops for damage review.

OCR API — extract VINs, plates, and claim identifiers from frames and documents.

Image Anonymization API — redact faces/plates to enable safe sharing and storage.

NSFW Recognition API — prevent brand-unsafe content from entering the record.

These components can be consumed as ready-to-go cloud APIs for speed, and extended with custom models where your taxonomy or operating constraints require it.

Deployment patterns that meet you where you are

Cloud-first: fastest pilot and broadest scalability with minimal IT lift.

Hybrid/edge: on-device or on-site prechecks (blur/glare, angle verification) to reduce bandwidth and meet latency or privacy needs.

Systems of record: seamless handoffs to DAMs, DMS/ERP, rental and claims platforms, and data lakes for analytics.

Governance and observability baked in

Lineage and immutability: every image and derivative (crops, diffs) is hashed and traceable end to end.

Policy as code: capture rules, anonymization thresholds, and retention schedules are centrally managed and versioned.

Metrics that matter: track appraisal/claim cycle time, dispute rate, supplement frequency, variance across locations, and out-of-service hours — then tie improvements to financial outcomes.

Executive takeaway

A zero-retouching pipeline converts messy real-world photos into standardized, privacy-safe, decision-grade evidence — automatically. It’s a pragmatic, API-first capability you can pilot in weeks: start with background removal for cars, add detection, OCR, and anonymization as KPIs move, and expand to custom models where differentiation compounds your advantage.

Controls, Compliance & Confidence (What Audit and Legal Need)

Standardizing vehicle inspection photos is only half the story. To withstand customer disputes, partner reviews, and regulator scrutiny, the imaging pipeline must be governed, traceable, and privacy-safe by design. The goal is simple: every decision can be explained, reproduced, and defended — without slowing the business.

Make every image evidentiary

Chain of custody: capture immutable hashes and timestamps the moment an image is taken; persist EXIF and device telemetry so you can prove where, when, and how it was captured.

Derivative lineage: maintain links from original frames to all derivatives (background-removed versions, panel crops, visual diffs). If a decision is challenged, you can reconstruct it step by step.

Tamper detection: reject uploads that have been edited outside the pipeline; watermark or sign approved outputs to prevent silent alterations downstream.

Enforce rules at the source, not in email

Policy-as-controls during capture: block submissions that miss required angles, fail blur/glare thresholds, or cut off key panels. This prevents non-compliant sets from entering the record.

Consistent grading rubric: pair standardized angles with calibrated severity guidelines; reviewers see the same views and apply the same definitions — reducing variance and bias.

Human-in-the-loop only for exceptions: route edge cases (poor weather, unusual body styles) for dual review; log overrides and justifications for audit.

Privacy and data minimization by default

Automatic redaction: blur faces and license plates in-line so car appraisal images and insurance claim photoscan move through customer communications and partner networks without manual edits.

Scoped retention and deletion: store only what’s required for the use case; apply time-bound retention and defensible deletion policies.

Regional residency and access control: pin storage/processing to approved regions; enforce least-privilege access with audit logging across all roles (capture agents, reviewers, partners).

Sensitive content gates: run NSFW and brand-safety checks to prevent reputationally risky imagery from entering systems of record.

Compliance that maps to real frameworks

Security posture: encrypt in transit and at rest; segregate environments for test vs. production; monitor for drift in configurations.

Regulatory alignment: support GDPR/CCPA principles (consent, purpose limitation, data minimization) with configurable settings and documentation packs for legal and DPO review.

Vendor governance: ensure third-party tools provide SOC 2/ISO 27001 attestations or equivalent; capture DPAs and subprocessors lists as part of the procurement trail.

Operational transparency that builds trust

Complete audit trails: record every action — capture, rejection, background removal, OCR, anonymization, review decision, override — along with who did it and when.

Explainability for stakeholders: provide side-by-side comparisons and highlight diffs so agents can show exactly what changed between intake and return, or pre-loss and FNOL.

KPIs tied to control health: track error/rejection rates at capture, policy bypass frequency, redaction coverage, and dispute outcomes. Surface these in executive dashboards alongside cycle time and leakage.

How APIs support governance (pragmatic choices)

Car Image Background Removal API delivers consistent, neutral backdrops — reducing bias and enabling reliable comparisons.

Image Anonymization API enforces privacy at scale by default, not as an afterthought.

OCR API extracts VINs, claim IDs, and lot tags to eliminate manual keying risk and strengthen evidence integrity.

Object Detection / Image Labelling APIs generate panel-level crops, ensuring the same regions are reviewed every time.

NSFW and Brand/Logo Recognition APIs act as guardrails for reputational and policy compliance before images reach humans.

Executive takeaway

Confidence in outcomes comes from controls you can prove: capture standards enforced automatically, privacy baked in, lineage preserved end to end, and decisions backed by transparent evidence. With an API-first approach, you can turn these requirements into routine operations — lowering dispute exposure, simplifying audits, and protecting brand and regulatory posture while speeding decisions.

Delivery Models — Build, Buy, or Blend (and the Cost Logic)

Choosing how to deliver standardized, decision-grade vehicle inspection photos is a strategy call. The right answer balances speed, control, and differentiation — without creating a hidden tax in engineering, compliance, or operations. Below is a pragmatic frame executives can use to decide.

Option 1: Buy (API-first) for speed and predictable unit economics

What it looks like: Drop-in cloud APIs handle the heavy lifting — vehicle-aware background removal, object/part detection, OCR for VINs and tags, anonymization, NSFW and brand checks.

Business upside: Fast pilot, short time-to-value, elastic scaling, and transparent per-image pricing you can forecast. Vendor SLAs transfer reliability risk off your balance sheet.

Hidden costs you avoid: Model training, dataset curation and labeling, MLOps tooling, edge-case maintenance, and 24/7 monitoring.

Risk to manage: Vendor dependency. Mitigate with an API gateway abstraction, exportable data, and side-by-side evaluation of two providers during pilot.

Good fit when: You need results in weeks, volumes are variable or seasonal, or this capability isn’t your core differentiator.

Fast start example: Standardize imagery with Car Image Background Removal API, then add OCR and Image Anonymization to make sets shareable and auditable.

Option 2: Build (custom) when the workflow is your moat

What it looks like: In-house models tailored to your taxonomy (damage classes, severity scales), camera policies, and compliance regime; integration with DMS/ERP/claims systems; optional edge components for offline or latency constraints.

Business upside: Full control over accuracy, latency, and roadmap; ability to encode proprietary logic; potential long-run cost advantage at very high, stable volumes.

Costs to plan for: Senior ML engineers, data engineers, and MLOps; data acquisition and labeling; synthetic data generation for rare cases; evaluation harnesses; CI/CD for models; monitoring for drift and bias; security and privacy reviews.

Risk to manage: Longer time to first value, talent retention, and ongoing maintenance.

Good fit when: You process at massive scale with stable demand, face strict data residency or no-cloud rules, or require niche logic that off-the-shelf tools don’t support.

Option 3: Blend to get the best of both

What it looks like: Use off-the-shelf APIs for standardized steps (background removal, OCR, anonymization) and add custom models where you differentiate (e.g., proprietary panel severity scoring, localized rules).

Business upside: Time-to-value of “buy” with the strategic control of “build.” You can A/B new models behind a stable interface and swap components without disrupting front-line teams.

Risk to manage: Interface complexity. Use an internal gateway and contract tests to keep components interoperable.

The cost logic executives should apply

Unit economics first: Model per-image costs (API calls, storage, bandwidth, human review) against throughput and seasonality. Buying tends to win below a certain volume or when variability is high.

TCO, not sticker price: Add compliance, security audits, incident response, observability, and retraining cycles. Custom efforts carry ongoing “care and feeding” costs that don’t show up on day one.

Break-even trigger points: Revisit build vs. buy if volumes stabilize at scale, latency requirements tighten beyond vendor SLAs, or differentiation demands custom labels and rules.

Option value: A blended approach preserves the option to in-house specific steps later — without pausing the business now.

Decision criteria to formalize in procurement

Accuracy & robustness: Performance on your imagery (lighting, weather, body styles); measurable improvement in dispute and cycle-time KPIs.

Latency & throughput: Meets real-time or batch SLAs during peak loads.

Security & privacy: Encryption, access controls, redaction defaults, and documented data flows; SOC 2/ISO posture and regional hosting where you operate.

Integration fit: SDKs, webhooks, logs, and error handling that your teams can operate; clear versioning and rollback plans.

Commercials & control: Transparent pricing, usage dashboards, rate-limit guarantees, and exit provisions (data export, model portability).

Roadmap alignment: Ability to influence features or commission custom work for your edge cases.

Execution playbook (crawl → walk → run)

Crawl (pilot): Standardize imagery with car-specific background removal in a few locations; enforce guided angles and basic quality gates. Measure appraisal/claim cycle time, dispute rate, and variance across sites.

Walk (expand): Add Object Detection / Image Labelling for panel crops, OCR for VIN and claim IDs, and Image Anonymization to enable safe sharing with customers, partners, and legal. Integrate decisions into your DMS/ERP/rental/claims systems with SLAs and audit logs.

Run (industrialize): Introduce custom models for your proprietary scoring, build A/B testing and drift monitoring, and formalize “policy as code” for capture rules, retention, and redaction. Optimize unit economics via workload orchestration (cloud/hybrid/edge) and negotiate volume bands.

Where a partner accelerates the journey

A provider that offers both ready-to-go vision APIs (e.g., Car Image Background Removal API, OCR, anonymization, object detection) and custom development services can de-risk each phase: stand up a pilot in weeks, then co-develop tailored models and workflows as KPIs improve. This keeps costs aligned to value milestones and avoids large up-front bets.

Executive takeaway

Treat image standardization as an operating capability, not a one-off project. Start with APIs to capture quick wins, blend in custom where it compounds advantage, and manage to unit economics and governance from day one. The result is faster decisions, fewer disputes, and durable control — on a roadmap your finance, legal, and operations leaders can all support.

Conclusion — Put the Vehicle, Not the Background, on Trial

C-level leaders don’t need more photos; they need decision-grade evidence. Isolating the car with background removal, enforcing like-for-like angles, and running a zero-retouching pipeline turns messy vehicle inspection photos into clear, comparable car appraisal images and defensible insurance claim photos. The payoff is straightforward: faster decisions, lower dispute exposure, steadier margins, and audit-ready records.

What you’re buying with this approach

Speed: fewer reshoots and escalations, faster appraisal and claim cycles.

Clarity: objective, standardized imagery that aligns pricing and severity across locations and partners.

Control: built-in privacy, lineage, and policy enforcement — evidence you can prove and defend.

Scalability: API-first components that handle volume without adding headcount.

Executive next steps (pragmatic and low-risk)

Set targets for 60–90 days: appraisal/claim turnaround time, dispute rate, variance across sites, supplement frequency, out-of-service hours.

Pilot a single step that moves the needle: insert car-specific background removal at capture to normalize imagery immediately. A ready-to-go option is the Car Image Background Removal API.

Layer capabilities as KPIs improve: add Object Detection / Image Labelling for panel crops, OCR for VINs and tags, and Image Anonymization to make sets shareable without legal friction.

Wire into systems of record: push outcomes and audit logs into appraisal tools, rental systems, and claims platforms with SLAs and role-based access.

Codify governance: enforce required angle sets, quality gates (blur/glare), retention windows, and regional data residency from day one.

Decide your delivery model: keep standardized steps as managed APIs for speed and predictability; invest in custom models where your taxonomy or operating constraints create durable advantage.

Risk controls to keep finance and legal comfortable

Vendor abstraction: route external calls through an internal gateway to avoid lock-in and enable side-by-side evaluations.

Change management: guided capture and instant feedback reduce training burden; exceptions go human-in-the-loop with documented overrides.

Evidence integrity: hash originals and derivatives; preserve lineage; block out-of-band edits; maintain complete audit trails.

Investment logic for the board

Treat this as an operating capability, not a one-off project. Start with variable, per-image costs (APIs) to capture early wins, then blend in targeted custom development where it compounds advantage. Over time, standardized inputs improve model performance, reduce rework, and unlock downstream automation — tightening unit economics quarter after quarter.

Where to begin

Launch a focused pilot: standardize a defined 8–12-angle set, insert background removal for cars at capture, and track KPIs weekly. If you prefer proven building blocks, API4AI offers ready-to-use services — Car Image Background Removal API, OCR, Image Anonymization, Object Detection, and more — plus custom computer-vision development when you’re ready to encode proprietary logic or meet edge/on-prem constraints. Start small, measure relentlessly, and scale what works.

Bottom line

Put the vehicle — not the background — on trial. Standardized, isolated imagery gives your teams the clarity to move faster, argue less, and make decisions that stand up to customers, partners, and auditors alike.